|

|

May 7, 2012 |

| THIS WEEK | |

|

A version of Edvard Munch’s iconic 1895 painting, The Scream, sold at auction in New York last week for $119.9 million, an all-time art auction record. The bidding took 12 minutes, not counting the cheering when the hammer fell. Cheers for over-the-top indulging? Sometimes you just want to you-know-what. But sometimes we can’t scream. On Capitol Hill this week, Politico reports, the House Budget Committee will be putting “the final touches” on an appropriations package that denies jobless Americans unemployment benefits “until they spend down their cash savings below $2,000.” Scream at that in the Budget Committee chambers, and you’ll be thrown out on your ear. Sometimes, on the other hand, we can just be too dumbfounded to scream. A mega millionaire who made his fortune playing private equity games with Mitt Romney at Bain Capital has a new book out. His theme: The more unequal America gets, the better life gets for everybody! We have more on this mega millionaire — and lots of his super-rich pals — in this week’s Too Much. Also this week: some constructive alternatives to screaming. |

About Too Much, |

| GREED AT A GLANCE | |

|

Aficionados of fine motor cars were gleefully shifting gears and slapping backs in Monaco last week at the nine-year-old event Motor Trend magazine has dubbed the world’s premiere “annual celebration of four-wheeled opulence.” At this year’s Top Marques Monaco, everything that glittered, notes Motor Trend, really seemed to be “gold, or some other shiny precious metal.” And everything else — like a 4.5-ton SUV from Dartz, a Latvian automaker — seems to be covered with inch-thick bulletproof glass. Prices? Stickers ranged up to $1.3 million for the Croatian Rimac Concept One, an electric car that can hit 60 mph in less than 3 seconds. Deep pockets had plenty of elbow room at this year’s Monaco auto show. A $75 admission fee kept the riff-raff at a distance . . .

What do today’s captains of industry do with all their loot? Forbes magazine last week gave us a glimpse at where all those millions are going, via a whimsical list of the “vain pursuits of the super rich.” Among the honored vainglorious: Amazon CEO Jeff Bezos, net worth $18.4 billion. Bezos is bankrolling the construction of a clock that’s designed to keep ticking for 10,000 years. To keep rain, snow, earthquakes, nuclear war, and other irritants from gumming up the clockworks, Bezos is having his timepiece buried in a mountainside. One nice touch: The clock will be programmed to have a cuckoo play every millennium. |

Quote of the Week “American society has everything imaginable: a huge, productive economy, vast natural resources, and a solid technological and educational base. Yet it is squandering these advantages because the rich have lost their sense of responsibility and are far more interested in their next yacht or private plane than in paying the price of civilization through honest and responsible taxation and investment.”

|

| PETULANT PLUTOCRAT OF THE WEEK | |

|

|

Stat of the Week In 2011, America’s average millionaire received nearly $450,000 worth of benefit from mortgage interest deductions and other federal “tax expenditures,” about $1,225 in benefits a day. The average daily food stamp benefit, notes Center for American Progress analyst Michael Linden, came in at $4.30. |

| inequality by the numbers | |

|

Take Action Visit Occupy Your Local Media and learn how to write a letter to the editor. Check 99% Power for a 99% Spring local action planned for your zip code. Move your money to send a message against big bank CEO profiteering. Urge the SEC to require companies to report their CEO-to-worker pay ratios. Start a Resilience Circle

|

|

| IN FOCUS | |

|

Wealthy of the World, Unite — and Party! From Manhattan to Monaco, the world’s super rich are fashioning themselves into a new global tribe of footloose and stateless. The rest of us get to gawk — and foot the ultimate bill. Back in 1863, in the middle of the Civil War, a short story took the American reading public by storm. Edward Everett Hale’s “The Man Without a Country” told the tale of a poor treasonous soul sentenced to spend the rest of his life endlessly sailing the seven seas, in perpetual exile, as a prisoner aboard Navy warships. How sad, sighed 19th-century Americans. How quaint, muse many of our 21st-century super rich. These awesomely affluent simply do not see statelessness as a penalty. They see statelessness as a goal. And the ranks of our contemporary “men without a country” are increasing. The number of Americans who’ve formally renounced their U.S. citizenship has jumped by over seven-fold, from 235 in 2008 to 1,780 last year. The spark for this surge in statelessness? Since 2008, U.S. tax officials have been endeavoring to clamp down more firmly on overseas tax evasion. Swiss private banks, for instance, have come under new pressure to divulge data on the millions wealthy Americans have stuffed in secret accounts. That pressure has some of those wealthy irritated enough to renounce their ties to Uncle Sam. The cost to renounce: a $450 paperwork fee and an “exit tax” on unrealized capital gains for renouncers who hold assets worth over $2 million — or have paid over $151,000 to the IRS in any recent year. But the affluent who’ve gone to the trouble of formally renouncing their citizenship make up just a tiny share of what the Financial Times has labeled the “stateless super rich.” These uber wealthy have no interest in the notoriety of renunciation. They just live their lives as if they had no nation to call their own. The most celebrated of these casually stateless? That would have to be Nicolas Berggruen, a 52-year-old worth over $2.3 billion who has spent the last decade hopping the world from one five-star hotel to another. The German-born Berggruen grew up in Paris and went to college in New York. He made a fortune in hedge funds and now hobnobs with world political leaders and Hollywood celebrities. Reporters have dubbed him the “homeless billionaire.” Few stateless super rich follow Berggruen from hotel to hotel. Most all of the vagabonding wealthy have personal residences. Lots of them. Typically, the Financial Times reported last month, a stateless super-rich household will have one or two properties in their “country of principal residence,” another in London, New York, or some other “global city,” a “holiday home” in a soothingly warm climate, and maybe still another in the Alps. They’ll shift their household, by season, from one to the other. Among the super rich, this perpetual-motion existence has become almost de rigueur, notes Jeremy Davidson, a London property consultant who handles properties that cost at least £10 million, the equivalent of over $16 million. “The more money you have,” explains Davidson, “the more rootless you become because everything is possible.” In their chase after ever fresher possibility, the stateless super rich have created an entirely new real estate market category. Realtors generally define this new “super-prime” category as the top 5 percent of properties in the global urban hotspots the world’s deepest pockets most enjoy frequenting. Price counts as no object in “super-prime” real estate. The rich see, the rich like, the rich refuse to take “no” for an answer. They merely up their offers, until they get legal title to the prime properties they most covet. Such “super-prime” bidding wars have kept the price of luxury real estate soaring at the same time the more ordinary global housing market is still reeling. So far this year in Manhattan, four luxury co-op apartments have sold for over $30 million each, a total, notes Crain’s New York Business, that matches the combined sales at that level over the previous three years. Just how many potential stateless super rich are currently roaming the world? Late last year, the Singapore-based Wealth-X consulting firm put the overall number of global ultra wealthy worth at least $500 million at about 4,650. These super rich together hold an estimated $6.25 trillion in assets. That’s more than enough, note urban planners, to create havoc in the hotspots where the stateless super rich most often gather. Their gathering, a veritable gentrification on steroids, tends to supersize prices for all sorts of local products and services — and price out local residents. The massive mansions and apartments pf the stateless super rich also exacerbate local housing shortages — and constitute as assault on any healthy sense of urban community. These super-rich properties sit idle most of the year. The resulting emptiness, notes Columbia University sociologist Saskia Sassen, sucks the neighborhood vitality out of great urban centers. The super rich don’t notice. Or care. They have no interest in putting down roots. During their brief seasonal sojourns, they live in isolation from the greater community around them. They venture out into local public life only long enough to corrupt it with trinkets for local pols who promise to keep tax rates toothless. The stateless protagonist in the classic short story Edward Everett Hale penned nearly 150 years ago ends up desperately yearning to rejoin the society he so treasonously spurned. Today’s stateless super rich don’t figure to display any similar yearning. They’re having too grand a time. At our expense. |

Email this Too Much

New Wisdom Paul Buchheit, Five Tax Fallacies Invented by the 1%, Common Dreams, April 30, 2012. Countering cheerleaders for grand fortune and their most cherished canards. Rich Miller, Higher Taxes Won’t Discourage Wealthy From Working Harder, Bloomberg Businessweek, May 1, 2012. Tax scholars pick apart the right-wing claim that the “talented” will work less if tax rates on the rich rise. Till van Treeck, Did Inequality Cause the Economic Crisis? Social Europe Journal, May 2, 2012. A readable analysis from a German researcher. Lawrence Mishel and Natalie Sabadish, It’s executives and the finance sector causing surging 1% income growth! Working Economics, May 2, 2012. An intro to the key numbers. John Knefel, Bored With Occupy — and Inequality, Extra! May 2012. America’s media giants, the data show, have lost interest in issues of equity. Brad Plumer, How economists have misunderstood inequality, Washington Post, May 3, 2012. An interview with James Galbraith. Paul Krugman, Plutocracy, Paralysis, Perplexity, New York Times, May 4, 2012. Inequality explains why our economy remains depressed — and why our response has mixed inaction and confusion. Rosamund Urwin, Is there anything left that money can’t buy? Evening Standard, May 4, 2012. A new book explores what happens to societies when the rich can buy most anything.

|

| In Review | |

|

Once Even Conservatives Liked to Tax the Top

Linda McQuaig and Neil Brooks have titled their latest book on the super rich the Billionaires’ Ball. An apt title. Amid austerity and hard times, the pair remind us in crisp and even entertaining prose, our rich dance on. McQuaig, a prominent Canadian columnist, and Brooks, a Toronto law school tax expert, have covered this ground before, in their 2010 book, The Trouble with Billionaires. That trouble, of course, continues, and the Billionaires’ Ball updates the story, with anecdotes and data aplenty to show how deeply — and dangerously — the super rich impact every aspect of our lives. But this update’s most memorable moments come when the McQuaig and Brooks duo take on the various rationalizations the super rich trot out to justify their ever grander accumulations of private wealth. These accumulations, McQuaig and Brooks convincingly point out, have no justification. Billionaires don’t create great wealth. They divert it. Billionaires don’t deserve great wealth. They have skimmed their fortunes off treasure “built up by the collective effort of generations.” This last eloquent phrasing comes from a little-remembered British philosopher, Leonard Hobhouse, who faced a century ago a plutocracy much like our own. Thinkers like Hobhouse, McQuaig and Brooks posit, can help all of us today think and talk more sensibly about taxes. Over recent decades right-wingers have recast how we as a society do this talking. They’ve labored relentlessly to position taxes as an abominable “assault on freedom.” Less rabidly anti-tax politicos, meanwhile, have come to treat taxes as at best a “necessary evil,” something we have to grit our teeth and pay — to raise enough revenue to keep the government’s lights on. But we need to see taxes, urge McQuaig and Brooks, as something far more essential to our social well-being. Through taxes levied progressively, we keep wealth from concentrating — and endangering both our polity and our economy.

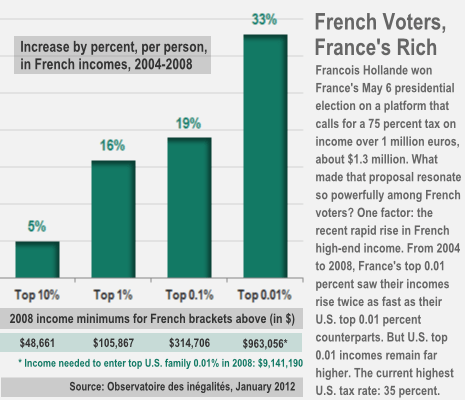

In mid-20th century America, McQuaig and Brooks go on to point out, even libertarian conservatives could understood and welcome this vital tax role. They introduce us to Henry Simons, a founder of the conservative Chicago School of Economics. Simons repeatedly advocated for taxing Americans most affluent at significantly higher rates than Americans of modest means. Conservatives like Simons, McQuaig and Brooks explain, recognized that the market economy they so valued “could only survive in a democracy if the general public benefited from it.” That reality, these conservatives felt, demanded the redistribution of the market economy’s bounty. Without progressive taxation, that bounty “ends up concentrated in the hands of the few.” McQuaig and Brooks close their new Billionaires’ Ball with a rundown of the tax changes needed to realize this long-lost conservative vision. They propose, among other initiatives, a 70 percent tax on both annual income over $2.5 million and inheritances over $25 million and the end to preferential tax treatment for income from dividends and capital gains. Tax changes alone, the two co-authors acknowledge, won’t clean up all the messes our billionaires have created. But taxes remain the key. A substantial recasting of the tax code has “the capacity to reduce inequality much more quickly and decisively” than any other step we can possibly take. Let’s get to it. |

Inequality Links Common Security Clubs/Resilience Circles Patriotic Millionaires

|

| About Too Much | |

|

Too Much, an online weekly publication of the Institute for Policy Studies | 1112 16th Street NW, Suite 600, Washington, DC 20036 | (202) 234-9382 | Editor: Sam Pizzigati. | E-mail: editor@toomuchonline.org | Unsubscribe. |

|

_______________________________________________________________________________

¶

ADVERT PRO NOBIS

IF YOU CAN’T SEND A DONATION, NO MATTER HOW SMALL, AND YOU THINK THIS PUBLICATION IS WORTH SUPPORTING, AT LEAST HELP THE GREANVILLE POST EXPAND ITS INFLUENCE BY MENTIONING IT TO YOUR FRIENDS VIA TWEET OR OTHER SOCIAL NETWORKS! We are in a battle of communications with entrenched enemies that won’t stop until this world is destroyed and our remaining democratic rights stamped out. Only mass education and mobilization can stop this process.

It’s really up to you. Do your part while you can. •••

Donating? Use PayPal via the button below.

THANK YOU.

____________________________________________________________________________________________________

Private equity’s Edward Conard amassed his fortune — now estimated in the hundreds of millions — working buyouts alongside his good buddy Mitt Romney at Bain Capital. Now Conard is claiming “public intellectual” status, and the New York Times

Private equity’s Edward Conard amassed his fortune — now estimated in the hundreds of millions — working buyouts alongside his good buddy Mitt Romney at Bain Capital. Now Conard is claiming “public intellectual” status, and the New York Times

Linda McQuaig and Neil Brooks, Billionaires’ Ball: Gluttony and Hubris in an Age of Epic Inequality. Boston: Beacon Press, 2012, 268 pp.

Linda McQuaig and Neil Brooks, Billionaires’ Ball: Gluttony and Hubris in an Age of Epic Inequality. Boston: Beacon Press, 2012, 268 pp.