Robert W. McChesney, Monthly Review

On the brink of the 2012 presidential election, and without considering that electoral contest itself, it is useful to comment on the state of U.S. democracy. The most striking lesson from contemporary U.S. election campaigns is how vast and growing the distance is between the rhetoric and pronouncements of the politicians and pundits and the actual deepening, immense, and largely ignored problems that afflict the people of the United States. The trillion dollars spent annually on militarism and war is off-limits to public review and debate.1 Likewise the corporate control of the economy, and the government itself, gets barely a nod. Stagnation, the class structure, growing poverty, and collapsing social services are mostly a given, except for the usual meaningless drivel candidates say to get votes. The billions spent (often by billionaires) on dubious and manipulative advertisements—rivaled for idiocy only by what remains of “news” media campaign coverage—serve primarily to insult the intelligence of sentient beings. Mainstream politics seem increasingly irrelevant to the real problems the nation faces; or, perhaps more accurately, mainstream politics is a major contributing factor to the real problems the nation faces.

On the brink of the 2012 presidential election, and without considering that electoral contest itself, it is useful to comment on the state of U.S. democracy. The most striking lesson from contemporary U.S. election campaigns is how vast and growing the distance is between the rhetoric and pronouncements of the politicians and pundits and the actual deepening, immense, and largely ignored problems that afflict the people of the United States. The trillion dollars spent annually on militarism and war is off-limits to public review and debate.1 Likewise the corporate control of the economy, and the government itself, gets barely a nod. Stagnation, the class structure, growing poverty, and collapsing social services are mostly a given, except for the usual meaningless drivel candidates say to get votes. The billions spent (often by billionaires) on dubious and manipulative advertisements—rivaled for idiocy only by what remains of “news” media campaign coverage—serve primarily to insult the intelligence of sentient beings. Mainstream politics seem increasingly irrelevant to the real problems the nation faces; or, perhaps more accurately, mainstream politics is a major contributing factor to the real problems the nation faces.

The degeneration of U.S. politics is a long-term process. It can be explained and it can be reversed. Indeed, the core problem was understood at the very beginning of democracy in Athens some 2,500 years ago. “Democracy is when the indigent, and not the men of property, are the rulers,” Aristotle observed in his Politics. “If liberty and equality are chiefly to be found in democracy, they will be best attained when all persons share alike in government to the utmost.”2

For that reason, capitalism and democracy have always had a difficult relationship. The former generates severe inequality and the latter is predicated upon political equality. Political equality is undermined by economic inequality; in situations of extreme economic inequality it is effectively impossible. The main contradiction of capitalist democracy (making it for the most part an oxymoron) lies in the limited role played by what was classically called the demos or the poorer classes, as compared to the well-to-do. Capitalist democracy therefore becomes more democratic to the extent that it is less capitalist (dominated by wealth) and to the extent to which popular forces—those without substantial property—are able to organize successfully to win great victories, like the right to unionize, progressive taxation, health care, universal education, old-age pensions, and environmental and consumer protections. In the past four decades such organized popular forces in the United States—never especially strong compared to most other capitalist democracies—have been decimated, with disastrous consequences. The United States has long been considered a “weak democracy”; by the second decade of the new century that is truly an exaggeration. Today, the United States is better understood as what John Nichols and I term a “Dollarocracy”—the rule of money rather than the rule of the people—a specifically U.S. form of plutocracy. Those with the most dollars get the most votes and own the board.

Dollarocracy is now so dominant, so pervasive, that it is accepted as simply the landscape people inhabit, much like the fact that the Rocky Mountains provide an unavoidable barrier if one wishes to travel from the Great Plains to the Pacific Ocean. By now, Americans—and certainly the punditocracy and what remains of the news media—are mostly inured to the corruption of our politics that results from having the politicians doing the bidding of large corporations and billionaires with little resistance. The notion of “you get what you pay for” applies in spades to the spoils of government, and the tens of billions spent by corporations and the wealthy on lobbying, public relations, and campaign donations translates into hundreds of billions, eventually trillions, in dollars worth of revenues. It is a large part of our overall economy.3

Lawrence Lessig’s 2011 Republic, Lost chronicles how much Congress has changed as a result of the influx of corporate lobbying dollars. A generation ago Mississippi Senator John Stennis thought it would be inappropriate to accept donations from firms that were affected by the work of the committee he chaired; today that is arguably the whole point of getting a committee chair. A significant portion of the work of being a member of Congress is about fundraising, and that is the main measurement of success on Capitol Hill. That and setting oneself up for a lucrative high six- or seven-figure annual income as a K Street lobbyist once one’s stint in Congress is done. In the 1970s 3 percent of retiring members became lobbyists; by 2012 the figure is in the 50 percent range.4 As Lessig makes clear, the corruption in Congress and across the government today is only rarely of the traditional bribery variety. It is instead a far more structural dependence upon corporate money built into the DNA of the political system—traditional payoffs are not necessary.

The major political fights in Congress today are most likely when large corporate lobbies square off against each other for the spoils of government, and a large part of the Congressional workload today, aside from fundraising, is mediating these conflicts so everyone gets a piece of the action. But when one corporate lobby has an overriding influence in a policy, or its main adversary is the public interest, fuhgetaboutit. Big pharmaceutical companies make hundreds of billions through getting free access to publicly funded research as well as shaping patent laws and regulations that allow them to charge consumers through the teeth?5 No problem. Cable and telephone firms get government licenses and quasi-monopolies basically to privatize the Internet and fleece consumers?6 That’s the American Way. Health insurance companies convert health reform into a program to expand their markets while maintaining their stranglehold over the flawed system with its insane cost structure? Hey, free markets are the name of the game. Oil and energy companies get tens of billions in annual government subsidies all the while derailing all significant measures to address the climate crisis?7 It’s morning in America!

Nowhere is the systemic corruption more apparent and deadly than in the manner in which the largest banks have effectively taken over the federal government. “Deregulating” the financial sector has been the signature policy move of Dollarocracy since the 1980s, and has been embraced by Republican and Democratic administrations alike. Much of the “deregulation” was about letting financial institutions enter formerly restricted areas, greatly enhancing both profits and risk, and therefore allowing a merger wave that would have been illegal under the banking regulation that prevailed during most of the post-Second World War era. In 1995 the six largest bank holding companies (JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, Goldman Sachs, and Morgan Stanley—some of which had somewhat different names at that time) had assets equal to 17 percent of U.S. GDP. By the end of 2006, this had risen to 55 percent, and by 2010 (Q3) to 64 percent.8 Too big to fail, indeed.

Former IMF economist Simon Johnson shined a light on what he termed “the quiet coup” in a devastating 2009 piece in the Atlantic. Johnson wrote of “the easy access of leading financiers to the highest U.S. government officials, and the interweaving of the two career tracks.” The financial sector went from getting 16 percent of corporate profits in the 1970s to over 40 percent of corporate profits by the new century, and executive compensation shot through the roof.9 Big Banks pushed for deregulations that allow them to speculate like drunk sailors, often bent and sometimes broke laws, and then, after they collapsed the global economy, received hundreds of billions (and access to trillions) in bailouts, while not a single executive went to prison.10 In 2009 alone the financial sector had seventy former members of Congress lobbying on its behalf.11 As Senator Richard Durbin famously put it, when Congress voted a blank check to the reviled big banks: “And the banks—hard to believe in a time when we’re facing a banking crisis that many of the banks created—are still the most powerful lobby on Capitol Hill. And they frankly own the place.”12

Nor was the White House or executive branch any different. As Glenn Greenwald documents, the Obama Administration simply elected not to prosecute bankers even when the evidence of illegal activity was clear; financial CEOs and billionaires have become effectively above the law.13

We could add in numerous other industries that receive similarly immense privileges. What is striking in almost every case is that these are industries where the giant firms are sometimes, perhaps frequently, disliked by much of the population. Even the vaunted Tea Party received part of its initial propulsion—before the Koch Brothers got out their checkbook and career dollarcrat Republicans grabbed the steering wheel—from widespread antipathy for how the government was serving Wall Street over Main Street. “The Tea Parties are right about the unholy alliance between business and government that is polluting the country,” David Brooks wrote in 2011, although by then it had assumed a strictly rhetorical stature, at least the closer one got to Washington, DC or to Republicans in power.14

Dollarocracy and Inequality

An important sign of Dollarocracy’s triumph may have been provided in the recent research of political scientists Larry Bartels, Martin Gilens, Jacob S. Hacker, and Paul Pierson. They demonstrate in independent studies and analyses that the interests and opinions of the great bulk of Americans have virtually no effect over the decisions made by Congress or executive agencies today, at least when they run up against the interests of either a powerful corporate lobby or wealthy people as a class. When the opinions of the poor diverge from those of the well-off, the opinions of the poor cease to have any influence. While there is a high likelihood that politicians will adopt the positions of their very wealthiest constituents, the research shows politicians will generally take the opposite position of that favored by the poorest third of their constituents.15

The other side of the coin in Dollarocracy is that those basic and essential government functions that do not necessarily have a major corporate industry lobbying for them get the short end of the stick. Public education and libraries are under constant attack, as their existence runs counter to the values of Dollarocracy.16 Social Security and Medicare, likewise, are in the crosshairs. Noted economist Joseph Stiglitz explains: “The more divided a society becomes in terms of wealth, the more reluctant the wealthy become to spend money on common needs. The rich don’t need to rely on government for parks or education or medical care or personal security—they can buy all these things for themselves. In the process, they become more distant from ordinary people, losing whatever empathy they may once have had.”17

The physical infrastructure of the nation—roads, transit, bridges, electrical and water systems—has become increasingly dilapidated and is pathetic by comparison to other advanced nations, whereas fifty years ago the United States was the envy of the world. Of course, this is penny wise and pound foolish for the champions of Dollarocracy—they seemingly would benefit in the long run by having an educated workforce and a world-class infrastructure—but the point of the system is to get while the gettin’ is good, and let some other chump worry about (and pay for) these abstract matters. A flustered E.J. Dionne observed that “The American ruling class is failing us—and itself.” He claimed, in language unimaginable a few years ago, “America needs a better ruling class.”18

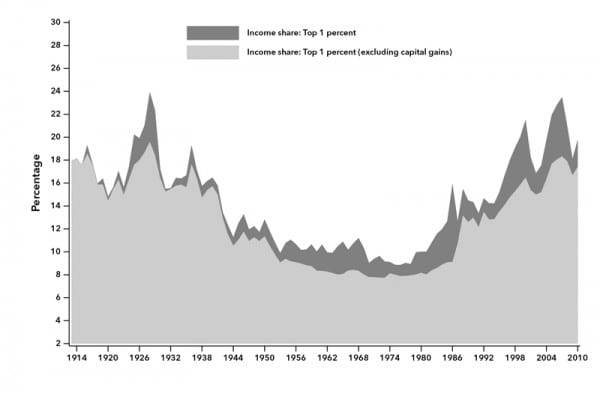

This leads to the evidence that best demonstrates the successful counter-revolution more than anything else: the dramatic shift in wealth and income away from the bottom 99 percent of Americans to the wealthiest 1 percent of Americans over the past three plus decades. More than anything else, Dollarocracy is all about shifting resources to the wealthiest Americans; the simplest assessment of whether it has succeeded is to look at the data. Charts 1 and 2 provide some graphic demonstration of the trend. The degree to which the United States’ income distribution has skewed over the past 35 years in an inegalitarian manner, primarily to the wealthiest 1 percent—and within that group, skewed toward the top one-tenth or even top one-onehundredth of 1 percent—is historically unprecedented and so dramatic it is almost impossible to wrap one’s mind around it. It is like trying to calculate the distance from Earth to a distant galaxy in centimeters using Roman numerals. Nearly all the gains in real income over the past generation have gone to the very richest Americans. If the United States had maintained the same income distribution it had in the 1960s or ‘70s in the 2010s, the bottom 90 percent of the population, and especially the bottom 60 percent, would be dramatically better off today. Instead, the United States is approaching levels of inequality found in the third world, leaving the other advanced economies with which it was comparable thirty-five years ago fading in its rear view mirror.19

Chart 1 shows the percentage of income accounted by the top 1 percent of the U.S. population since the First World War. By the beginning of the twenty-first century the income share of the top 1 percent had once again reached the level attained in the late 1920s, just prior to the Stock Market Crash that led to the Great Depression. And just as in 1929, this once again led to a financial crash and depression (referred to by Paul Krugman as the “Lesser Depression”).20 Only this time the 1 percent seem to be much more successful at retaining their income share in spite of the crisis. As Timothy Noah wrote for the New Republic in an article entitled “The One Percent Bounce Back” in March 2012, “The top 1 percent’s income share peaked in 2007, fell the following two years, and then began growing again in 2010. As of 2010 the one percent’s income share remained below the 2007 peak. But give it time.”21

Stiglitz states that establishment economics has provided no credible evidence to justify anything remotely close to America’s staggering inequality.22 The punditocracy and the politicians tell us increasing inequality is a function of a new global economy that rewards skilled workers and the necessary consequence of an innovating and dynamic economy. Hacker and Pierson, in their extraordinary 2010 book Winner-Take-All Politics, systematically demolish this rationale for growing inequality. They establish that the skewing of American incomes was due primarily to major policy changes, especially pro-billionaire revisions in the tax code, changes in trade policies and business regulations, and the weakening of organized labor.23

Regarding taxation, in 1961, families with annual incomes of at least $1 million paid on average 43.1 percent of their income in federal income taxes; in 2011 the percentage fell to 23.1 percent. Corporations paid on average 47.4 percent of their profits in federal taxes in 1961; in 2011 the percentage fell to 11.1 percent.24 Warren Buffett, one of the three or four wealthiest persons in the world, made headlines in 2011 when he called attention to the absurd situation that he was paying a lower income tax rate than his employees or many American middle-class workers. “Legislators in Washington,” Buffett wrote, “feel compelled to protect” mega-rich people like himself “as if we were spotted owls or some other endangered species.”25

Chart 1. Income share of top 1 percent, United States, 1917–2010

Source: Facundo Alvaredo, Anthony B. Atkinson, Thomas Piketty, and Emmanuel Saez, “The World Top Incomes Database,” http://g-mond.parisschoolofeconomics.eu/topincomes.

Dollarocracy has been hostile to the interests of organized labor at every turn and has been able successfully to game the system so it has been all but impossible to launch successful private-sector unions since the 1970s, even when evidence suggests workers would very much like union representation. (Public sector unions have survived and grown because governments cannot engage in the same union-busting activities as corporations.) This has enhanced inequality directly, as a 2011 study in the American Sociological Review demonstrated, because unions are a significant factor in raising the wages not only for union workers, but for all workers in the labor market. Unions also tend to promote more egalitarian wages among workers.26 The loss of private sector unions has enhanced inequality indirectly, too, because unions are the one organized institution that has the resources and strength to be a political adversary to corporations and the wealthy. When unions are out of the picture, Dollarocracy has a much easier task getting and keeping political power, and that means an acceleration of policies promoting inequality.

A mountain of research has been generated in the past decade on the consequences of growing inequality for the health of U.S. society, or any nation for that matter. It is not just the economic damage that inequality creates; nor is it just that inequality undermines the possibility for political democracy. Richard Wilkinson and Kate Pickett’s The Spirit Level has earned justifiable acclaim for its careful documentation of how increasing inequality—far more than simply the actual amount of wealth/poverty in the society—damages almost every measure of well-being, from life expectancy and mental health and violence to human happiness. This is largely true for the very rich, the beneficiaries of Dollarocracy, as well as the poor. People and cultures thrive in more egalitarian societies.27

These policy changes were hardly inevitable, nor were they desirous; they reflected the naked, brute power of corporations and the wealthy over the political process. In other advanced economies where the political balance of power remained closer to the postwar standards, such dramatic changes were not enacted, and those countries have fared, as a rule, better than the United States. They are certainly less unequal, though they have their problems. In the United States, these policy changes were championed at all times by the Republicans, but the Democrats have generally been willing accomplices. Often times it was the Democratic Party leadership that made possible the more egregious concessions to corporations and the wealthy, like trade deals, financial deregulation, and reduced income tax rates for billionaire hedge-fund managers.

In making this argument I do not mean to romanticize U.S. politics of the 1960s or ‘70s. This was an extraordinarily turbulent period and a remarkably large portion of Americans thought social inequality, militarism, racism and poverty, even political corruption, were so severe at the time that they required radical solutions. The 1972 Democratic presidential candidate George McGovern argued passionately that, “at no time have we witnessed official corruption as wide or as deep as the mess in Washington right now.”28 While some of the economic and social problems of those days seem almost quaint by today’s Dollarocracy and depression standards, the important point is simply that the political culture at the time was better equipped to deal with popular dissent; it even contributed to a progressive like McGovern getting the Democratic Party nomination, the last time someone not in bed with the moneyed interests was able to do so. It was still very much an uphill battle, to which the demonstrations and riots of the period attest, but organized people were more serious players in U.S. politics than they have been subsequently.

A more concrete sense of the change in the political culture is found in the career of consumer advocate Ralph Nader. In the 1960s and early ‘70s Nader and his activist organizations of “Nader’s Raiders” were able to win a stunning series of legislative and regulatory victories for consumer rights, open governance, and environmental regulation. The accomplishments of this revitalized consumer movement are scores of laws and regulations, including the creation of the Environmental Protection Agency and the Occupational Safety and Health Administration, the passage of the Freedom of Information Act, and the seminal 1966 National Traffic and Motor Vehicle Safety Act. Not for nothing is it said that Ralph Nader has saved more lives than any American except Dr. Jonas Salk. Nader was arguably the most popular living American. He stood for honest and effective government and against corrupt crony monopolistic capitalism. He encouraged a generation of young people to take an optimistic view that organized political activity was capable of positive outcomes, and that public service was an honorable life’s work.

Nader was Public Enemy No. 1 to the champions of Dollarocracy, if only because job one for the latter was to eliminate the notion of the government as a progressive force on behalf of an informed and organized citizenry. (Job two was to eliminate the notion among the young of public service as a worthy career goal.) In the 1970s the corporate community organized to limit or terminate Nader’s influence and, by extension, the myriad of activist groups that he, along with the women’s, student, and civil rights movements, had inspired to influence public policy by grassroots organizing.29 By the Carter administration, the corporate campaign began to bear fruit and by the 1980s Nader and his ilk were cast into the wilderness, as there is no place for his work under Dollarocracy. He then turned to the next stage of his career, as a prophetic voice against corruption and corporate power and as a periodic presidential protest candidate.

The Economics of Dollarocracy

No more important example of the dominance of Dollarocracy exists than the changing debates over economic policy. During the postwar decades U.S. economic policymaking was steadfastly committed to capitalism and corporate profitability, but the prevailing vision at that time, now sometimes called “the golden age” of U.S. capitalism, was one where the foundation of a successful economy was a relatively prosperous working class or middle class. The idea was that as worker productivity increased, labor compensation would as well so workers would get a portion of the gains in output. Workers would then use their increased income to purchase more products from businesses, hence boosting the economy forward. The government would play a central role in assuring a smooth economy without deep recessions, and keeping the economy out of depression like the one that enveloped the capitalist world in the 1930s.

Of course this vision of a full-employment capitalism and of a “social contract” between capital and labor was never extended to the workforce as a whole; was only conceivable in the very favorable historical conditions of the post-Second World War years; and was dependent even then on racial segregation, expanding empire, and Cold War militarism. The only times that the United States reached anything like full employment in the immediate postwar decades were during the Korean and Vietnam Wars.

Still, in the postwar years, full employment was a stated core goal of federal policymakers, and as recently as 1978 Congress passed the Humphrey-Hawkins Act which required the federal government to create jobs for workers if the private sector was incapable of providing for full employment. In this climate, even Republicans like Richard Nixon gave limited consideration to a guaranteed annual income for all adult Americans as a way effectively to eliminate poverty once and for all. Though not known for his veracity, Nixon famously stated that “We are all Keynesians now,” to describe this activist role in economic policies; and indeed during his presidency civilian government spending (government consumption and investment) as a percentage of GDP reached record heights, never surpassed before or since.30

The corporate right seemingly tolerated this approach in times of high growth—or possibly found it politically untouchable—but as the economy stagnated in the 1970s, it came to regard this “Keynesian” approach, with its emphasis on high wages and full employment, as an intolerable barrier to corporations’ immediate and future profitability. When the pie is growing, capital can get a bigger slice and allow labor to have a somewhat bigger slice as well. When the pie is not growing, the only way capital can increase its slice is by diminishing labor’s slice. In this zero-sum world the government would continue to play a central role, but the policies would be geared toward lowering costs for corporations, including wages, and maximizing the post-tax profits. Deregulating finance, expanding private and consumer debt, and shipping manufacturing jobs to low-wage areas become the favored policies.31 Dollarocracy has been obsessed with changing the terms of the political discussion about the economy and how best to encourage economic growth, and to a large extent it has succeeded.

By the second decade of the twenty-first century the postwar era seems like some sort of bizarre parallel universe where gravity works backwards. The range of legitimate policy debate about the economy is now dominated by the corporate right and has been returned to the era of Herbert Hoover and Treasury Secretary Andrew Mellon, if not the age of the robber barons:

- Budget deficits are the main problem of the economy and their elimination is a necessary precondition for growth, especially if the deficit can be attributed to social programs that benefit the bulk of the population. Budget deficits, however, are not a problem—are not to be raised as an issue—where tax cuts on the corporate “job creators,” increases in military spending, or bailouts of banks and giant corporations are concerned.

- The tax rates on the wealthy and regulations on business that existed in the 1950s to ‘70s undermine investment and economic growth. Business creates jobs and government basically interferes with the private sector as it attempts to create jobs. Real jobs are those connected to a profit-making venture, even if it is something as dubious as a gambling casino or a porn shop.

- Not real jobs are those jobs connected to government spending, even if it is for something of immense social value, like mass transit, education, or health care. Labor unions, rather than bolstering incomes and thereby creating a more prosperous population able to purchase goods, serve to drive up costs and choke off profitable investment; they get in the way of the “job-creators.”

- Monopolistic mergers and enormous corporations are no particular danger to the economy; indeed they generally make the economy more efficient and competitive.

- Inflation is a more serious threat to the economy than unemployment.

- Unemployment is not necessarily all that bad, as it keeps wages down, makes workers “hungrier,” and makes the United States more competitive.

- Extensive poverty, growing inequality, and tens of millions unemployed or underemployed are regrettable—but the only way to address them is to make business happy and stick to the conventional wisdom.

- The environment is not an economic issue, and efforts to address ecological calamity should not put additional expenses on corporations or interfere with profit making.

My argument is not that all politicians from both parties adhere to these postulates like some sort of blood oath. My point is that these austerity principles have become the default position of economic debates within the mainstream, because they reflect the values and interests of very powerful interests, of Dollarocracy. It is true that some politicians, especially backbencher Democrats who truly find aspects of Dollarocracy’s economics offensive, or those needing to scrounge votes in a tight election, will make bold public pronouncements contrary to this received economic wisdom. But actions speak louder than words. In recent years, on the whole the Democrats, when push comes to shove, have rarely challenged these presuppositions in any meaningful manner.

Astute observers will see that much of this was the dominant thinking up to the Great Depression. Such views were discredited and roundly repudiated during the depression and the more prosperous postwar era. The traditional capitalist austerity view in the face of economic crisis, as John Maynard Keynes definitively demonstrated in his General Theory of Employment, Interest, and Money, offered little real hope of escaping economic stagnation. Today, because such supply-side capitalist views are generally accepted as the starting point for economic policymaking by both political parties, there is likewise little hope to escape the economic stagnation in which the system is now mired—a deepening tendency toward stagnation is in fact endemic to the entire phase of monopoly-finance capital.32 In this context all workers, and the impoverished and the unemployed in particular, carry the brunt of austerity, having little economic power and scarcely more political leverage.33

Chart 2 starkly illustrates the trend. Since the 1970s increases in real GDP have been detached from real median family income—a further manifestation of the dramatic gains made by the Dollarocracy. The increased income created in the economy has gone almost entirely to the wealthy, not to the workers. This is even more startling when one considers that these were decades when women entered the labor force in large numbers increasing the number of workers, and hours worked, per household.34 As a result higher consumer spending on the part of the larger part of the population became more dependent on debt, so that households could maintain their standard of living. People increasingly were driven to utilize the equity in their houses like credit cards, which contributed to a vast speculative bubble in the economy—until the bubble burst in the 2007–2009 Great Financial Crisis.35 With consumption once again contracting, markets were saturated and business, faced with vast amounts of idle productive capacity, saw even less reason to invest. U.S. corporations today are sitting on around $1.7 trillion in cash and have no plans to invest it because there is no market demand for additional products.

Chart 2. Index of Growth in Real GDP Per Capita and Real Median Family Income, 1960–2010

Sources: “Median family income, 1947–2010 (constant 2011 dollars),” Economic Policy Institute, Open Data, http://stateofworkingamerica.org/data; “GDP per capita (constant 2000 dollars),” World Bank National Accounts Data and OECD National Accounts Data Files, http://databank.worldbank.org.

Accordingly, the overall rate of economic growth has been slowing down since the 1960s. The first decade of the new century was the worst since the Great Depression—a true lost decade that lived off speculation and debt until the markets crashed; and the current decade, left to the policies of Dollarocracy, will almost certainly be worse in terms of growth than the last one. Not only has the economic pie been sliced to give ever larger portions to the top 1 percent, it has stopped growing so there are fewer resources for everyone else or to pay for socially necessary projects. Working-class living standards are plummeting. There may be no policy solutions to all of the growth problems endemic to contemporary corporate capitalism—it may well be that consideration of a new economy is in order. But, that point notwithstanding, some policies (if not stymied by the Dollarocracy) could stimulate greater employment and more sustainable economic development than the United States has enjoyed in recent decades.36 These policies—like strict antitrust law enforcement, progressive taxation, strict controls over credit and financial markets, single-payer health insurance, vibrant labor unions, and massive public works projects—generally bump up against powerful corporate interests. Hence Dollarocracy has a comfort zone with stagnation and austerity far greater than that of the general population. Here the decline in the political influence of organized labor is felt directly.

This is an issue that has perplexed many left-liberal reformers. How can the capitalists be so shortsighted as to oppose the use of government to build infrastructure, create jobs, and end stagnation when the historical record appears to demonstrate that democratic governments have it within their power to make capitalism operate far more efficiently and effectively? Can’t these business interests look at the historical track record and see that ultimately capitalism was far more stable in the higher-wage, higher-growth, relatively full-employment economies following the New Deal, and in the social democratic nations of northern Europe? Why do they obsessively cling to the antiquated economic theories that were discredited in the 1930s and ‘40s, which have led present-day capitalism to crisis, stagnation, and decline? Some of the more independent, free-thinking liberal economists like Paul Krugman are almost apoplectic as they chronicle the absurdity and tragedy of this apparent paradox.

In his 2012 book End This Depression Now! Krugman supplies an answer to this riddle. He cites a classic 1943 essay by Michal Kalecki, the great Polish economist who independently of Keynes developed the crucial breakthroughs in the theory of employment in the 1930s associated with the Keynesian revolution (and who became a close friend and advisor to Monthly Review in the 1950s and ‘60s).37 Kalecki argued that if the public realizes the government has the resources to establish full employment, it would undermine the notion that the central duty of the government is to instill business confidence so that it will invest in creating jobs. If the population widely understood that government policies could guarantee full employment, Kalecki observed, a “powerful indirect control over government policy” enjoyed by business would end, a prospect discomfiting to business.38 “This sounded a bit extreme to me the first time I read it,” Krugman writes, “but it now seems all too plausible.”39 A successful state generating full employment might logically lead people to question why capitalists have so much economic power and what purpose they provide that could not be better provided by more democratic means. In short, the wealthy and corporations would prefer a depressed and stagnant economy to a growing one led by state policies, if those in any way jeopardized their control over the government and their dominant position in society.

Of course there are other possible answers to the above riddle as well. Monopoly-finance capital at the beginning of the twenty-first century is quite a different animal from the “golden age” monopoly capitalism of the post-Second World War years. Today we are faced with a far more financialized and globalized system. Financial power has gained in relation to industrial power and is increasingly in the driver’s seat, economically and politically.40 Neoliberalism is not simply an aberration or a misstep but represents the political counterpart of this more financialized system. Capitalism today is arguably more interested in protecting its financial assets and capital gains (and its monopoly power) than in the risky enterprise of investment in new productive capacity. Much of production (and employment) is globalized, relying on cheap labor in the global South, or what is termed global labor arbitrage.41 In this transformed environment the old Keynesian, nation-state-based “solutions” are less viable than ever. This is the context in which the current neoliberal Dollarocracy has emerged and prospered.

Dollarocracy, then, is more than wealthy and powerful corporate lobbies dictating policies and getting lucrative subsidies, favorable regulations, collapsing unions, and low tax rates. It represents the triumph of neoliberalism and the transformation of the political domain into a domain of dollars, making the notorious corruption of the Gilded Age seem tame by comparison. Dollarocracy raids the treasury like a private feeding trough. It constantly moves on to wherever there is new big game to be bagged: stripping the government for parts, sometimes called the “outsourcing” of public services, and the handing off of these to corporations, who increasingly manage our prisons, conduct key military functions, and even direct (while privatizing and degrading) our schools. These private firms then generate guaranteed healthy profits by tapping into public monies, and in some cases by degrading public services so as to promote private “alternatives” funded with public money. The evidence today suggests that while outsourcing is becoming a corporate cash cow, there are few if any benefits for taxpayers and citizens and many problems, not the least of which is a lack of accountability.42 The government’s own bipartisan study of military outsourcing in Iraq and Afghanistan, for example, revealed of the $180 billion in outsourced contracts it examined, that at least $30 billion was stolen, lost, or wasted.43 Not surprisingly, one of the areas in which the Dollarcrats have cut the federal budget to the bones is in regard to those very officials charged with monitoring and accounting for spending and enforcement of contracts.44 It is basically open season for graft and all kinds of chicanery.

We find it difficult to avoid Lessig’s conclusion that the first and immediate effect of the corrupt political regime in Washington is “bad governance.”45 Thomas Frank argues that this is not ironic; it is precisely the point of Dollarocracy. What better way, he argues, to make the case for government being inherently evil than to run government in a grotesquely incompetent and corrupt manner when in power?46

The Consequences of Dollarocracy

Dollarocracy’s effects extend beyond the political-economic issues just discussed, though that is its foundation. Three issues that threaten the survival of the Republic, and that Dollarocracy exacerbates, deserve mention: the environmental crisis, the military expansion, and the erosion of civil liberties.

The first of these, the environmental crisis, has received just a smidgen of the attention it requires. The ongoing economic activities in the United States are exacerbating the problem, getting us ever further from the dramatic policies that climatologists and other scientists say are necessary for human existence to remain even remotely close to what has been the case for the past 10,000 years. To some extent this is simply a consequence of a market economy, where the environment is an “externality” and will always be given short shrift by economic actors who have competitive pressures upon them to maximize profit regardless of the consequences.

But the environmental problem is greatly magnified under Dollarocracy, because as corporate interests effectively dominate government, they undermine the capacity of the democratic state to address market failure on behalf of the general public.47 Indeed, facing up to the ecological calamity seems so impossible for Dollarocracy that it has abandoned even feigning interest; in recent years there has been a pronounced effort, bankrolled in part by energy corporations, to deny that environmental crises even exist. Dollarocracy does not give the impression of having much of a “long-term view.” The only quote of Keynes they seem to have remembered is his quip, “In the long run, we are all dead.”48

Second, the United States accounts for around half of the world’s military spending (counting only its acknowledged military expenditures), although it represents less than 5 percent of the world’s population.49 The United States has a massive nuclear arsenal and enough weapons to kill every living creature many times over. It has some one thousand overseas military bases and installations, extending over much of the globe, and is engaged in a chain of wars and military buildups in Asia (as well as in other areas of the global South)—so that there is never any peace, much like Oceania’s war with Eurasia in Nineteen Eighty-Four.50 Few Americans have any idea why the nation is at war or how one war leads to another, or indeed about the nature of U.S. empire. War and empire are complex matters, but the one factor that is certain is that corporations are making a killing on the trillion-dollar war and war-preparation budget and on the exploitation of much of the globe that this makes possible; and they provide an exceptionally powerful lobby to see that the imperial war complex remains sacrosanct. The peace forces on the other side are equipped with excellent arguments and a proverbial peashooter. The balance of power has shifted dramatically to the forces of militarism; wars that once would be protested and ended after a few years now can go on permanently, even with precious little popular support. For U.S. capital military spending serves as a sponge to absorb excess productive capacity and to support employment, increases profit margins and overall profits, and keeps the world open for multinational corporations.

Dollarocracy may allow for some cuts in military spending—after all, who are we in an arms race with when our military spending equals or exceeds that of the rest of the world put together?—but even at its outer limits, these cuts will only be marginal. As Andrew Bacevich states, “within Washington, the voices carrying weight in any national security ‘debate’ all share a predisposition for sustaining very high levels of military spending for reasons having increasingly little to do with the well-being of the country.”51 The likelihood is just as good that militarism will increase, as it is Dollarocracy’s favorite form of economic pump-priming.52

Third, as inequality grows and corruption deepens, our civil liberties are on softer ground. Militarism also expedites this process, with its emphasis on secrecy and hierarchy. Under Dollarocracy the foundation of our freedoms is slipping. This is seen most directly in the Patriot Act and other national security measures that compromise our constitutional liberties, and give the state extraordinary ability to police the citizenry on flimsy grounds. As Daniel Ellsberg has commented, “all the crimes Richard Nixon committed against me are now legal.”53

Under Dollarocracy the threat to civil liberties is enhanced because of the sharp increase in government outsourcing of military activities, prison management, and surveillance to corporations like Halliburton and Xe (formerly Blackwater) that are even less accountable than the government. But it is also seen in the broader corporate invasion of privacy, typified by marketing and the Internet, where there is enormous money to be made monitoring and collecting information on people all their waking hours. The cozy relationship between the government and our largest corporations makes this process easier rather than more difficult.

More broadly, this should be understood as part of the collapse of the “rule of law,” the essential democratic value that everyone is treated equally before the law. It has never been the case that the rich and poor, powerful and powerless, have received evenhanded treatment before the law. Even where they do receive formally equal treatment it simply exacerbates the real inequality of their positions. As Anatole France said, “The law, in its majestic equality, forbids the rich as well as the poor to sleep under bridges, to beg in the streets, and to steal bread.” But under Dollarocracy the rules themselves have become more and more one-sided, enshrining double standards that explicitly favor the rich and those serving their interests. Those “too big to fail” receive bailouts, everyone else pays the penalty. Government officials face no consequences for illegal wars or torture or violations of international law. Powerful bankers and telecom company executives face no prosecution for lawbreaking. Yet poor people are being rounded up, prosecuted, and incarcerated in record numbers, for crimes that barely register in gravity by comparison. As Glenn Greenwald forcefully documents, the legitimacy of the entire system hangs in the balance.54

If there is any sort of iron law, it is that civil liberties cannot survive in a sharply economically unequal society. One need not look at a Pinochet-style police state to get the answer; in fact, for our purposes it is better to look at semi-pseudo democracies like Mexico or Egypt for much of the late twentieth century. In those societies the wealthy and elites tended to have a reasonable amount of freedom, and freedom diminished as one went down the social pecking order and as the political ideas became more threatening to those in power. As Dollarocracy continues to widen the class divide, and generate ever more poverty, this looks more and more to be the U.S. future as well.

The present state of freedom for the poorest 25 percent of Americans is a far cry from that experienced by the wealthiest 10 percent. One major factor has been the war on drugs, which has been the major domestic policy initiative over the past three decades. This war has been directed overwhelmingly at poor communities, especially people of color, and has led to an extraordinary increase in prisons and prisoners, often for mere possession of illegal recreational drugs. Prison and police spending has increased markedly compared to spending on education by government over the past three decades. It is Dollarocracy’s favorite civilian government program, the domestic version of military spending.55 In 1980, for example, 10 percent of California’s budget went to higher education and 3 percent to prisons; in 2010, almost 11 percent went to prisons and only 7.5 percent to higher education.56 As Michelle Alexander documents, the drug war has shredded constitutional protections and consigned a significant percentage of poor and working-class African-American males to permanent status as felons, which means a formal loss of the right to vote and protection from employment and housing discrimination. She makes a compelling case that this system is so extensive it constitutes a “new Jim Crow.”57

In sum, Dollarocracy is an excellent system for those with plenty of dollars but not very good for everyone else. And, eventually, the problems it creates or accentuates—and that it makes much more difficult to address—result in an unsatisfactory world for everyone.

Politics and Depoliticization

Some two decades ago a number of our smartest observers, people like Kevin Phillips and William Greider, saw that the problems described above were mounting and growing larger. They both anticipated or advocated the equivalent of another New Deal, to bend the stick back toward democracy.58 Lester Thurow noted in the early 1990s that economic inequality had already grown in the United States at a greater pace than any other nation in history during peacetime. Many expected a popular revolt, like that periodically seen in the streets of Paris or Athens. Yet nothing close to reform was in the offing, and the problems have only grown worse, much worse. Why this has been the case has been one of the important issues of our times. Why it should remain so under Dollarocracy, as problems grow ever more severe, is even more puzzling.

A response emerged, finally, and thankfully, in the great public popular outbursts of 2011. But simply to point to these welcome demonstrations begs the question of why it has taken so long for such protest to emerge—and why they seem to ebb more than flow.

“Depoliticization” is the term to describe this phenomenon; it means making political activity unattractive and unproductive for the bulk of the citizenry. This is, to varying degrees, an important and underappreciated issue for all democratic societies where there are pronounced economic inequalities. It moved to the fore when all the great battles over suffrage were won and there was universal adult suffrage. Scholars have pointed out that some, perhaps much, of the impetus for the creation of the field of “public relations” a century ago was to lessen popular understanding of and opposition to corporate power, and to discourage informed popular participation in politics. The idea was to “take the risk out of democracy” in a society where the majority of potential voters may not be sympathetic to the idea that government’s job was first and foremost to serve the needs of big business and the wealthy few.59 An omnipresent commercial culture that emphasizes consumption over civic values, and a lack of organized political power, go a long way toward greasing the wheels for depoliticization. Twentieth-century voting turnout among eligible adults in the United States has been low compared to much of the rest of the world and its own nineteenth-century standard. It has been a generally depoliticized society, even before Dollarocracy.

The value of depoliticization is well understood to rulers, who tend to prefer a population that voluntarily disengages rather then one that needs to be suppressed violently to get it to cooperate. The actions of General Augusto Pinochet, the convicted serial human rights abuser, torturer, mass murderer, and dictator who (with U.S. support) overthrew Chile’s elected socialist government in 1973, speak louder than words. Five years into his dictatorship Pinochet could see that Chile would have to return eventually to some semblance of constitutional civilian rule, as mass demonstrations were growing, and even for a psychopath like Pinochet, there were effective limits to the use of violence. He commissioned the top political scientist in Chile who supported his dictatorship to draft a new constitution for a democratic Chile. What Pinochet wanted to prevent was a return to pre–1973 Chile, where voter turnout rates were above 90 percent and the citizens were routinely regarded as among the most engaged and civic-minded in the world.

How to solve the problem of having a democracy in form but not in substance? Pinochet sent the political scientist to the United States to learn how to devise a democracy American-style, one where relatively few people care much about politics, if only because no matter which party wins nothing much ever changes. The structure of the economy is effectively off limits for political debate. Pinochet’s constitution was enacted and Chile returned to civilian government under it in 1990. By 2011, Chile was rocked with the largest student demonstrations in its history, with one demand being the replacement of Pinochet’s constitution with one democratically drafted and approved, a constitution more concerned with creating the basis for participatory self-government than protecting property.

Under Dollarocracy the promotion of depoliticization moves front and center. The uprisings of the 1960s sent tremors through elite circles. The elite group the Trilateral Commission published its report The Crisis of Democracy in 1975 in response to this threat of too much democracy by the wrong people. It concluded that “the effective operation of a democratic political system usually requires some measure of apathy and noninvolvement on the part of some individuals and groups.”60 Dollarocracy depends and thrives upon depoliticization. If one looks closely one will see that there are no campaigns or even lip service about getting everyone to vote because it is a civic duty coming from the dollarcrats; quite the contrary. Beneath it all is a candid recognition that the policies of Dollarocracy are fundamentally elitist and unpopular with the majority of the people. Paul Weyrich, founder of the Heritage Foundation and one of the great organizers of the corporate right since the 1970s, put it bluntly in a 1980 speech to conservative activists: “I don’t want everybody to vote…our leverage in the elections quite candidly goes up as the voting populace goes down.”61

The United States of the past generation is a classic example of a depoliticized society: most people know little or nothing about politics and are estranged from it except at a superficial level. Young people are constantly reminded it is not “cool” to be political, and the point of life is to take care of number one. The evidence suggests that most people, especially working-class and poor people, have no influence over politicians and policy, so to the extent people understand their real status they will lose incentive to participate. Regardless of which party wins it seems like nothing ever changes that much, at least for the better; elections are often fought over symbolic issues only loosely related to actual policies or actual political values. It is a game played by and for elites, where tangible issues of import can be in play. But it is a spectator event for others, who are seen by the elites as objects to be manipulated.

Lessig recently described an example of the cynicism of politicians toward voters. He tells of being at a 2011 event with White House senior political adviser David Axelrod and beltway celebrity journalist Joe Klein. Lessig, a former colleague and longtime supporter of Obama’s, had marshaled a sizable number of 2008 campaign speeches, in which Obama professed his commitment to taking money and corruption out of politics and that would be the highest possible priority for him when he got to the White House. It was a major theme of his campaign by any reckoning. Lessig explained to Axelrod and Klein that the young people he worked with who were all strong Obama supporters and organizers in 2008 had become incredibly disillusioned when they saw how as soon as Obama got into power, it was business-as-usual for lobbying, pro-corporate policies, and endemic systemic corruption. It became clear nothing was going to be proposed, let alone enacted. Axelrod and Klein each responded with bewilderment, saying they found it hard to believe anyone would take the rhetoric in campaign speeches seriously.62

It is worth noting at this point that the electoral system itself goes a long way toward contributing to political disengagement. The two parties have rigged the system—in a manner having little to do with the U.S. constitution—so that it is virtually impossible to launch a credible third party. One is reminded of the late great George Carlin’s famous line that Americans love choice and have plenty of it…except where it actually matters, like with telephone companies or political parties. In politics the duopoly acts, as economic theory explains, much more like a classical monopoly than a competitive marketplace.

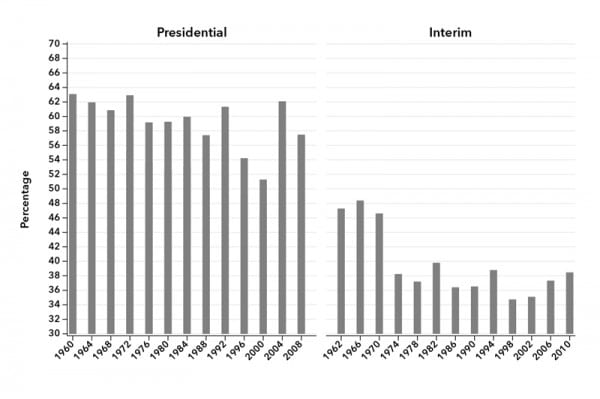

Chart 3. Voter Turnout* in U.S. Elections, 1960–2010

* Voter Turnout is here defined as the percentage of the voting-age population that voted.

Source: Voter Turnout Website, International Institute for Democracy and Electoral Assistance (International IDEA), accessed September 20, 2011 http://idea.int/vt.

The two parties also gerrymander—e.g., draw district boundaries—so that as many congressional and legislative districts as possible are divvied between themselves, and only a minority are competitive, except in rare landslide years. As a rule, a good 85 percent of House members are in what have been gerrymandered to be “safe seats,” and they rarely face a tough reelection battle, despite the strong generic unpopularity of Congress.63 Often the only state or federal races a voter faces that are remotely in play are statewide races where gerrymandering is impossible. At that point one butts up against the matter of how much money it takes to run a credible campaign.

Is it any wonder people have become demoralized and depoliticized? Chart 3 demonstrates the low level of voting among adults in the United States and how it has evolved over the past forty years. Elections in presidential election years get the greatest turnout of voting-aged citizens, though since the early 1970s it has seldom broken 60 percent. Most other elections are lucky to get 40 percent turnout, which means one can get elected governor of Virginia (an odd-year election race) or mayor of Chicago or countless other state and local offices with the votes of fewer than one in five voting-age adults. So much for majority rule. That being said, what may be most striking is not how few Americans vote compared to other actually existing democracies, but rather how many actually do vote in view of the factors undermining the legitimacy of the process.

The best predictor for whether or not a person votes is their income. Table 1 compares the relative number of voters in the lowest and highest income quintiles. On average during the past four presidential elections, despite increasing low-income voter turnout, for every ten voters from the lowest income quintile there are sixteen voters in the highest income quintile. Voter participation increases step-by-step with income. Dollarocracy is based on a system where those with more dollars have more reason to vote. John Kenneth Galbraith noted two decades ago that the pro-corporate policies of the U.S. government did not reflect the desires of a majority of Americans, merely a majority of those who voted.64

Table 1. Ratio of Number of Voters in the Top Quintile to Bottom Quintile in Presidential Elections

The popular support for Dollarocracy in the United States—demonstrated since the Reagan era through elections—has always been overrated. As far back as the 1970s research by scholars like Walter Dean Burnham lent credence to the notion that if Americans voted across income levels at the same rate as most northern European nations, the nation would be electing governments with far greater sympathy to social democratic policies.65 Research demonstrated that Americans have not moved to the right on a battery of core political issues since the 1970s; indeed, they may have become more progressive.66

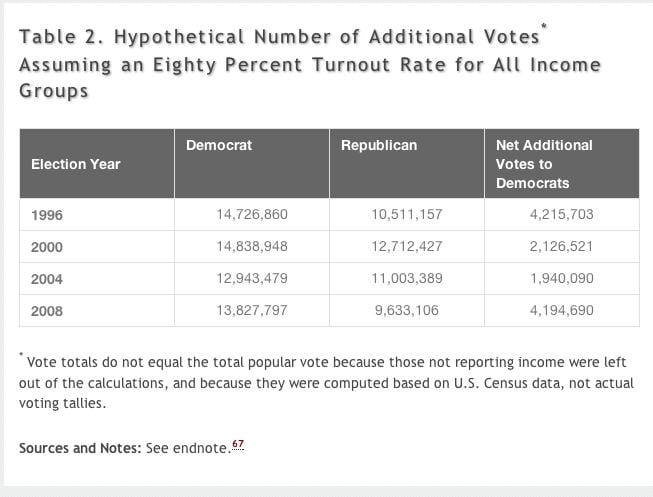

Research into voting and income, shown in Table 2, suggests that if Americans at all income levels voted at an 80 percent turnout rate—typical in the nineteenth-century United States and some other democracies today—and if they voted in the same proportion for parties as the other members of their income group do at present, the Democracts would have won landslide victories so large as to represent a critical realignment of party politics in three of the last four presidential elections, and would have been in shooting distance of winning in 2004. With voting equalized across class lines, Democrats would likely have dominant, possibly veto-proof, majorities in Congress.

Table 2. Hypothetical Number of Additional Votes* Assuming an Eighty Percent Turnout Rate for All Income Groups

Of course, this is all hypothetical and a thought game; if 80 percent of all Americans voted, the current parties as they are known and understood likely would be considerably different from what they are today, or they would not exist. To attract this much wider working-class vote would require a transformed Democratic Party more like what it was in the 1930s during the New Deal, and therefore would mean a considerable break with the Dollarocracy.

A striking indication of the conversion of the Democrats into Dollarocracy’s junior partner came in 1984, when Walter Mondale was the party’s presidential nominee. By conventional standards, the chances of defeating President Reagan—then benefitting from an economic recovery—were all but hopeless. Early in the campaign, Mondale’s aides prepared a 250-page internal report that concluded that “the only way Mondale can win is by pitching his appeal to the white working class and minorities, not the middle class.” Mike Ford, Mondale’s field director, argued that a Mondale victory “is nearly impossible with the current electorate…. We must consider dramatic and perhaps high-risk strategies.” Ford specifically recommended an intense voter registration drive to get six million new black, Hispanic, and union voters. For the effort to succeed, it would be imperative to offer the new voters a compelling populist political interest in actually voting. Democratic Party leaders rejected this proposal, and opted to use available funds for get-out-the-vote campaigns among the existing electorate.68 One can only speculate why the Democrats elected to ignore this approach in 1984, and thereafter, but the instinct to appeal to business and its resources looms large.

Nothing has changed for the Democrats in the subsequent years. As two leading political scientists put it in 2002, “today neither party makes much effort to mobilize the tens of millions of poorer and less well educated Americans who are not currently part of the electorate.”69

What is important is that the proponents of Dollarocracy are faced squarely with a situation where a majority of voters, not to mention all adult Americans are opposed to the current plutocratic system and want a dramatic change in course. The growing crisis is getting the attention of formerly apathetic Americans, and their involvement in the system poses a major problem for Dollarocracy. This is the political context of our times, and is perhaps not sufficiently appreciated by the opponents of Dollarocracy. The notion that conservative, corporate interests and their fundamentalist allies in the religious right could win free and fair elections, a common belief back in the Reagan era, has been quietly abandoned. Job one has been to bring a massive influx of cash into campaigns effectively to buy elections; for every voter the TV ads might influence there are innumerable people who will be so grossed out as to become apolitical. That is perhaps almost as good from the Dollarcratic standpoint. But neither buying elections nor driving off voters turned off by an inane political culture were deemed sufficient.

Just as essential was destroying the basis of a potential opposition, and particularly the supply of money to those forces that might oppose Dollarocracy. Much of the impetus for eliminating public sector unions—private sector unionization has already collapsed over the past three decades—is that these have traditionally been the only non-corporate groups that rank in the list of top ten campaign funders, and all the other groups on the list give largely to Dollarcratic politicians. Those most interested in maintaining the Dollarcratic political and economic structure (Republicans but also most Democratic Party high rollers) will do everything in their power to maintain the draconian restrictions on ex-prisoners being able to vote, as well as maintain the drug war that removes countless poor people, especially African-American men, from the voting rolls every year. This is now more than a question of a given election, but rather a necessity in keeping democracy from functioning—a necessity for the ruling class/power elite.

This has now been extended into a more general strategy aimed at suppressing the vote among constituencies most hostile to Dollarocracy; hence shrinking the number of actual voters to make the range of outcomes skew heavily toward candidates doing the bidding of corporate interests. Most striking, in fourteen states where they held control of both branches of the legislature and the governorship, the Republicans passed strict voter identification rules and a number of related measures with the very thinly disguised purpose of simply keeping poor, minority, and young voters away from the polls, and making voting such a pain-in-the-ass that likely anti-Dollarocracy voters will simply blow it off. The notion that there is a serious problem with “voter fraud” justifying these extreme measures has been systematically and meticulously discredited by Lorraine Minnite.70 “Study after study,” E.J. Dionne writes, “has shown that fraud by voters is not a major problem—and is less of a problem than how hard many states make it for people to vote in the first place. Some of the new laws, such as those limiting the number of days for early voting, have little plausible connection to battling fraud.”71 A comprehensive review of the 2011 voter law changes by the Brennan Center for Justice at the NYU Law School concluded that they “could make it significantly harder for more than 5 million eligible voters to cast ballots in 2012.”72 One civil rights advocate terms these changes “the most serious setback to voting rights in this country in a century.”73

None of this should surprise us. Capitalist democracy, which has always been more about capitalism than democracy, has been a formidable tool for ensuring stability in a society dominated by those with substantial property. But the historical high-water mark of the union of property, legitimacy, and stability in the name of “democracy” is now in the past. The carefully cultivated belief that we live in a society governed by the demos (the popular classes) is patently absurd in the face of the reality of Dollarocracy. The task before us, then, is to shine so bright a light on the gross abrogation of democracy in the contemporary United States as to give rise to a social revolt aimed at the creation of a genuinely democratic and egalitarian order: socialism by its or any other name.

ABOUT THE AUTHOR

Robert W. McChesney is Gutgsell Endowed Professor of Communications at the University of Illinois at Urbana-Champaign, and author of The Political Economy of Media (Monthly Review Press, 2008) and, with John Nichols, The Death and Life of American Journalism (Nation Books, 2010). This article draws some of its material from two forthcoming books: Robert W. McChesney, Digital Disconnect: How Capitalism Is Turning the Internet Against Democracy (New Press, 2013), and John Nichols and Robert W. McChesney, Dollarocracy (Nation Books, 2013). R. Jamil Jonna is responsible for the charts and tables in the piece, and the research that provides their basis. The author also thanks Patrick Barrett for numerous valuable comments and suggestions.

______________

Notes

↩ Actual U.S. military expenditures (including all categories) are now over a trillion dollars but the acknowledged military spending associated with the Department of Defense is much less. For a full accounting for 2007 see John Bellamy Foster, Hannah Holleman, and Robert W. McChesney, “The U.S. Imperial Triangle and Military Spending,” Monthly Review 60, no. 5 (October 2008): 1–19.

↩ Aristotle, Politics, trans. Benjamin Jowett (Stilwell, KS: Digireads, 2005), 60. Aristotle of course was no friend of democracy but a supporter of an aristocratic constitution. Moreover, even the supporters of the demos in ancient Greece had in mind only male citizens, excluding women and slaves. See Ellen Meiksins Wood and Neal Wood, Class Ideology and Ancient Political Theory (New York: Oxford University Press, 1978).

↩ Journalists like Ken Silverstein, David Cay Johnston, and Robert G. Kaiser have each written devastating accounts of Washington’s corruption at the hands of corporate lobbyists and moneyed interests. See Ken Silverstein, Washington on $10 Million A Day (Monroe, ME: Common Courage Press, 1998); David Cay Johnston, Free Lunch (New York: Penguin, 2007); Robert G. Kaiser, So Damn Much Money (New York: Knopf, 2009).

↩ Lawrence Lessig, Republic, Lost (New York: Twelve, 2011), 99, 123.

↩ Robert Weissman, “The Role of Federally-Funded University Research in the Patent System,” testimony before the Committee on the Judiciary, U.S. Senate, October 24, 2007, http://essentialaction.org; Dean Baker, “The Levers of Power,” CounterPunch, February 8, 2011, http://counterpunch.org.

↩ See John Bellamy Foster and Robert W. McChesney, “The Internet’s Unholy Marriage to Capitalism,” Monthly Review 62 no. 10 (March 2011): 1–30.

↩ See http://priceofoil.org/fossil-fuel-subsidies,as well as the work of Public Citizen at http://citizen.org.

↩ Simon Johnson, “The Bill Daley Problem,” The Huffington Post, January 9, 2011, http://huffingtonpost.com.

↩ Simon Johnson, “The Quiet Coup,” the Atlantic, May 2009, http://theatlantic.com.

↩ See Matt Taibbi, Griftopia (New York: Spiegel & Grau, 2010).

↩ Lessig, Republic, Lost, 99, 123.

↩ Ryan Grim, “Dick Durbin: Banks ‘Frankly Own The Place’,” Huffington Post, May 30, 2009, http://huffingtonpost.com.

↩ Glenn Greenwald, With Liberty and Justice for Some (New York: Metropolitan Books, 2011), chapter 3.

↩ David Brooks, “Pundit Under Protest,” New York Times, June 13, 2011, http://nytimes.com.

↩ See Larry M. Bartels, Unequal Democracy (New York: Russell Sage Foundation, 2008); Martin Gilens, “Inequality and Democratic Responsiveness,” Public Opinion Quarterly 69, no. 5 (2005): 778–96. There is a superb discussion of this in Jacob S. Hacker and Paul Pierson, Winner-Take-All Politics (New York: Simon & Schuster, 2010), chapter 4.

↩ See, for example, Charles Simic, “A Country Without Libraries,” New York Review of Books blog, May 18, 2011, http://nybooks.com/blogs.

↩ Joseph E. Stiglitz, “Of the 1%, by the 1%, for the 1%,” Vanity Fair, May 2011, http://vanityfair.com.

↩ E.J. Dionne, “American Needs a Better Ruling Class,” syndicated column, April 17, 2011, http://heraldnews.com.

↩ “Is the US Becoming a Third World Country?” The Map Scroll, April 15, 2009, http://mapscroll.blogspot.com.

↩ Paul Krugman, “The Lesser Depression,” New York Times, July 21, 2011, http://nytimes.com.

↩ Timothy Noah, “The One Percent Bounce Back,” New Republic, March 4, 2012, http://tnr.com.

↩ Stiglitz, “Of the 1%, By the 1%, For the 1%.”

↩ Hacker and Pierson, Winner-Take-All Politics.

↩ Chuck Collins, et. al., “Unnecessary Austerity, Unnecessary Shutdown,” Institute for Policy Studies, April 7, 2011, http://ips-dc.org.

↩ Warren Buffett, “Stop Coddling the Super-Rich,” New York Times, August 14, 2011, http://nytimes.com.

↩ Bruce Western and Jake Rosenfeld, “Unions, Norms, and the Rise in U.S. Wage Inequality,” American Sociological Review 76, no. 4 (2011): 513–37.

↩ Richard Wilkinson and Kate Pickett, The Spirit Level (New York: Bloomsbury Press, 2009).

↩ George McGovern, An American Journey (New York: Random House, 1974).

↩ Lost to history, for example, has been the very impressive burgeoning media reform movement of the 1970s. See Pamela Draves, ed., Citizens Media Directory (Washington, DC: National Citizens Committee for Broadcasting, 1977).

↩ See John Bellamy Foster and Robert W. McChesney, “A New New Deal under Obama?” Monthly Review 60, no. 9 (February 2009): 1–11.

↩ See Judith Stein, Pivotal Decade (New Haven: Yale University Press, 2010); John Bellamy Foster, Robert W. McChesney, and R. Jamil Jonna, “The Global Reserve Army of Labor and the New Imperialism,” Monthly Review 63, no. 6 (November 2011): 1–31.

↩ John Bellamy Foster and Robert W. McChesney, The Endless Crisis (New York: Monthly Review Press, 2012).

↩ Robert Reich, “Why Washington Isn’t Doing Squat About Jobs and Wages,” June 4, 2011, http://robertreich.org.

↩ Lawrence R. Mishel, et. al., The State of Working America 2012 (Ithaca, NY: Cornell University Press, forthcoming), http://stateofworkingamerica.org, 436.

↩ John Bellamy Foster and Fred Magdoff, The Great Financial Crisis (New York: Monthly Review Press, 2009).

↩ For an excellent example of creative policy thinking see the June 27, 2011 special issue of The Nation, “Reimagining Capitalism,” edited by William Greider. It includes a dozen or so articles with concrete proposals that are all outside the range of legitimate debate.

↩ On Kalecki’s relation to the Keynesian Revolution see Joan Robinson, Contributions to Modern Economics (Oxford: Basil Blackwell, 1978), 53–60.

↩ Michal Kalecki, Selected Essays on the Dynamics of the Capitalist Economy (Cambridge: Cambridge University Press, 1970), 139.

↩ Paul Krugman, End This Depression Now! (New York: W.W. Norton, 2012), 94–95.

↩ See John Bellamy Foster and Hannah Holleman, “The Financial Power Elite,” Monthly Review 62, no. 1 (May 2010): 1–19.

↩ See Foster and McChesney, The Endless Crisis, chapter 5.

↩ Richard A. Oppel, Jr., “Private Prisons Found to Offer Little in Savings,” New York Times, May 18, 2011, http://nytimes.com.

↩ Christopher Shays and Michael Thibault, “Reducing Waste in Wartime Contracts,” Washington Post, August 28, 2011, http://washingtonpost.com.

↩ John Gravois, “More Bureaucrats, Please,” Washington Monthly, March/April 2011, http://washingtonmonthly.com.

↩ Lessig, Republic, Lost.

↩ See Thomas Frank, The Wrecking Crew (New York: Metropolitan Books, 2008).

↩ Al Gore wrote an essay in 2011 making this point. See Al Gore, “Climate of Denial,” Rolling Stone, July 7, 2011, http://rollingstone.com. See also Naomi Klein, “Capitalism vs. the Climate,” The Nation, November 28, 2011, 11–21.

↩ John Maynard Keynes, A Tract on Monetary Reform (London: Macmillan, 1923), 80. Keynes was justifying his focus in this work on the short-run rather than the long-run in economics.

↩ Foster, Holleman, and McChesney, “The U.S. Imperial Triangle and Military Spending.”

↩ Nick Turse and Tom Engelhardt, “All Bases Covered,” Antiwar.com, January 10, 2011, http://original.antiwar.com.

↩ Andrew Bacevich, “Why Military Spending is Untouchable,” CounterPunch, January 27, 2011, http://counterpunch.org. For an analysis of the common (and largely unregulated) practice of retired generals moving to defense firms for extremely lucrative careers, and guaranteeing the maintenance of the military budget among other things, see Bryan Bender, “From the Pentagon to the Private Sector,” Boston Globe, December 26, 2010, http://articles.boston.com.

↩ In Oliver Stone’s 2009 documentary, South of the Border, former Argentine president Nelson Kirchner recounts a conversation with then-president George W. Bush in which Bush angrily rejected any government spending on infrastructure or social spending programs to expand the economy. Bush shared with Kirchner the secret of macroeconomics in the United States: “The best way to revitalize the economy is war. The United States has grown stronger because of war. All the economic growth of the United States has been encouraged by the various wars.”

↩ Quote from the 2009 film about Ellsberg, The Most Dangerous Man in America, directed by Judith Ehrlich and Rick Goldsmith.

↩ Greenwald, With Liberty and Justice for Some.

↩ Hannah Holleman, et. al., “The Penal State in an Age of Crisis,” Monthly Review 61, no. 2 (June 2009): 1–17.

↩ Jimmy Carter, “Call Off the Global Drug War,” New York Times, June 16, 2011, http://nytimes.com.

↩ Michelle Alexander, The New Jim Crow (New York: The New Press, 2010).

↩ Kevin Phillips, The Politics of Rich and Poor (New York: Random House, 1990); William Greider, Who Will Tell the People? (New York: Simon and Schuster, 1992).

↩ The classic text is Alex Carey, Taking the Risk Out of Democracy (Urbana: University of Illinois Press, 1996).

↩ Michael Crozier, Samuel P. Huntington, and Joji Watanuki, The Crisis of Democracy (New York: New York University Press, 1975), 114.

↩ Glenn W. Smith, “Republican Operative: ‘I Don’t Want Everyone to Vote’,” FireDogLake, October 12, 2008. http://firedoglake.com.

↩ Interview with Lawrence Lessig, Media Matters radio program, WILL-AM radio, November 20, 2011, http://tunein.com.

↩ Lessig, Republic, Lost, 97; Mark Green, Selling Out (New York: Regan Books, 2002), 130.

↩ John Kenneth Galbraith, The Culture of Contentment (Boston: Houghton Mifflin, 1992), 10.

↩ Walter Dean Burnham, “The Appearance and Disappearance of the American Voter,” in Thomas Ferguson and Joel Rogers, eds., The Political Economy (Armonk, NY: M.E. Sharpe, 1984), 112–37.

↩ See Hacker and Pierson, Winner-Take-All Politics

↩ Sources: U.S. Census Bureau, “Reported Voting and Registration of Family Members, by Age and Family Income,” various years; National Election Pool, Edison Media Research, and Mitofsky International, “National Election Pool General Election Exit Polls, 2004 [Computer file],” ICPSR version (Ann Arbor, MI: Inter-university Consortium for Political and Social Research [distributor], 2005); ibid., “National Election Pool General Election Exit Polls, 2008 [Computer file],” ICPSR version (ICPSR, 2010); Voter News Service, “Voter News Service General Election Exit Polls, 1996 [Computer file],” ICPSR06989-v2 (ICPSR, 1997); Ibid., “Voter News Service General Election Exit Polls, 2000 [Computer file],” ICPSR06989-v2 (ICPSR,2004).