Introduction by Jack Balkwill / LUVNews

[dropcap]Politico[/dropcap] has a piece this morning asking “Will cheap oil kill Keystone?” (see article below)The thing that makes the Keystone pipeline profitable is the high price of oil, because it is expensive for our ruling Forces of Greed (FOG) to collect this extremely dirty oil.

The current problem of the ruling FOG is that Saudi Arabia has realized that a future of the West producing so much of this extremely crude oil, even as so many nations convert to renewable solar and wind power, may leave them at some point sitting on an ocean of oil that nobody needs. While the world is still dependent on oil for providing the lion’s share of energy, the Saudis have chosen to sell their light sweet crude at much lower prices, in effect, strangling such competition as that which would come from the tar sands of Canada (and elsewhere).

Meanwhile, the fossil fuel burning is destroying our environment and the ruling FOG are doing all they can to prevent a meaningful solution. For the latest on this, we highly recommend this week’s Clearing the FOG program, the best radio program on the internet. They describe this week’s program:

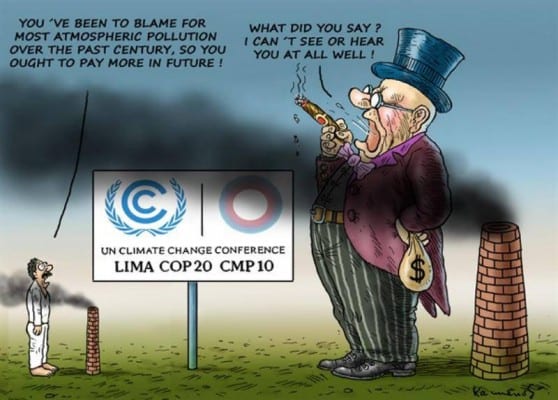

“The COP 20 talks have just concluded in Lima, Peru and now eyes are turning to the next treaty expected to be signed in Paris in December, 2015. So far, the United Nations’ COP process has failed to produce a meaningful agreement to address the climate crisis and to achieve climate justice. The United States has been a great obstacle to progress. And the UN talks have essentially devolved into another tool for commodifying the Earth and pushing a neo-liberal economic agenda. We speak with Brian Tokar, author of the newly-revised “Toward Climate Justice: Perspectives on the Climate Crisis and Social Change” about new organizing and a new framework that are pushing for real solutions to the climate crisis. We also speak with Karen Orenstein of Friends of the Earth about the Lima talks and how the Paris Treaty is shaping up.”

Lima to Paris – Will the UN Solve the Climate Crisis? with Brian Tokar and Karen Orenstein by Clearingthefog on Mixcloud

Will cheap oil kill Keystone?

Elana Schor

[dropcap]Greens who want [/dropcap]President Barack Obama to kill the Keystone XL pipeline are adding a new weapon to their arsenal of protests and lawsuits — the world’s glut of cheap oil.

The same collapse in oil prices that is pumping dollars into motorists’ wallets also risks undermining the case for building the 1,179-mile pipeline in two crucial ways: It’s squeezing the western Canadian oil industry that has looked to Keystone as its most promising route to the Gulf Coast. And anti-pipeline activists hope that falling prices will make it politically safer for Obama to reject the project, despite the new Republican Congress’ pledges to put Keystone at the top of its 2015 energy agenda.

Much of the glut occurred out of Saudi calculations to stay alive in a global market that may eventually shrink as oil is replaced with other forms of energy (however tardily), but also as a result of Washington’s pressures to make the Russian economy scream.—Eds.

“Oil prices going low gives the president a landing place to reject the pipeline because Canada needs cheap and big infrastructure,” said Jane Kleeb, founder of the anti-Keystone group Bold Nebraska. “When oil prices are high, producing the expensive and high-carbon tar sands makes sense. But now that oil is low, the only way tar sands will continue to expand is if Canada gets big pipelines.”

U.S. oil prices have plunged by nearly half since late June, tumbling to around $58 a barrel on Friday, thanks to the refusal of OPEC to cut production amid a glut of global supplies. Gasoline prices have fallen to a five-year low at the same time, reaching a national average of $2.60 a gallon Friday morning.

The oil price is crucial to the Keystone debate because the latest State Department environmental study on the project says prices in the $65-to-$75 range are a potential danger zone for oil production in western Canada — the point where transportation costs driven higher by failing to build the pipeline could “have a substantial impact on” the industry’s growth.

Cheaper oil also makes it easier to blame Keystone for the greenhouse gases that the Canadian oil fields send into the atmosphere. The State Department study said Keystone would be blameless for all that carbon because Canada is likely to keep pumping more oil even without the pipeline, sending the crude to the U.S. by truck or train if necessary. But the rail and truck options are more expensive — so if cheap oil makes them no longer cost-effective, greens argue, the pipeline would be the thing that keeps the pollution coming.

Oil prices were nearing $100 a barrel when the State Department study came out in January, making the caveats about falling prices seem far-fetched. But now various price analysts, from Goldman Sachs to the Energy Department, are forecasting U.S. oil prices below $75 a barrel for 2015.

Such pain in the oil patch delights Keystone’s enemies, who see the pieces falling into place for Obama to kill the project — even before a pivotal Nebraska Supreme Court ruling on the pipeline’s route that might come as early as Dec. 19. They also like to point to a June 2013 speech in which Obama said the U.S. should approve Keystone “only if this project does not significantly exacerbate the problem of carbon pollution.”

“It is now impossible to credibly argue that Keystone XL won’t enable significant expansion of the tar sands and associated climate emissions,” Natural Resources Defense Council international program attorney Anthony Swift said by email. “Plummeting global oil prices have highlighted the fact that tar sands only work in a world of expensive crude — and without cheap pipeline infrastructure, many carbon-intensive tar sands projects simply will not be built.”

Canada continues to pin its hopes on the new Republican Congress giving new life to the $8 billion pipeline’s political hopes. But Canada’s heavy-fuel producers are facing a cash crunch as cheap crude chokes profits for some of the industry’s most expensive new projects, and Prime Minister Stephen Harper declared last week that trying to regulate oil emissions during the current price crash would be “crazy economic policy.”

Everywhere you look in the region, companies are cutting back: The company Canadian Oil Sands sliced its 2015 budget nearly in half compared with this year’s spending. Baytex slashed its dividends to stockholders by more than half, announcing a focus on U.S. oil assets. Cenovus described its 15-percent budget cut for 2015 as “capital restraint in the year ahead in the face of weaker oil prices.”

Keystone developer TransCanada says its shippers remain committed to the project and points out that existing oil sands projects may be pricey to build but are much cheaper to run, even with a fire sale on crude. The company’s Keystone president, Corey Goulet, said in an interview that “even one year” of sagging oil prices would not make the pipeline a must-have for Canadian crude producers.

“Keystone XL is not the driver for increased oil production out of the oil sands,” Goulet said. “It’s really the long-term price of oil, and even one year is a short time in the types of 20- or 30-year investments these folks are considering.”

But Goulet also told a Nebraska radio station last week that the fall of oil prices heightens Keystone’s importance as a cost-effective alternative to oil-by-rail. Heavy oil producers’ profits “are shrinking because the cost of production remains the same” even as oil becomes cheaper, he said.

That plays into greens’ argument that rejecting the pipeline would cut emissions in the oil-sands region because trains aren’t a viable alternative to Keystone when the price of oil falls. Jason Kowalski, policy director for the climate activists at 350.org, likened Goulet’s words to a recent pro-pipeline speech in which likely GOP presidential hopeful Chris Christie warned that rejecting Keystone “risks stunting growth” in the oil sands — inadvertently echoing the greens’ case.

Stephen Kretzmann, founder of the green group Oil Change International, challenged TransCanada’s portrayal of the current downturn in U.S. oil prices as temporary. Some futures markets see crude staying below $75 a barrel “over the next decade,” he said.

“With oil prices at this level, that makes a significant difference” as Canadian heavy oil companies plan their futures, Kretzmann added.

Sen. Bernie Sanders, one of Congress’ strongest Keystone critics, put it simply: Given the “abundance of oil on the marketplace and prices going down,” there’s little “need to drill and produce” more of Canada’s heavy fuel.Sen. Mike Johanns, a Nebraska Republican who’s had a front-row seat for his state’s Keystone drama, said activists’ focus on cheap oil for their anti-pipeline campaigns is “short-sighted thinking” that would “pound consumers” once a shortage of pipelines pushes fuel prices back up.“The people who suffer aren’t Bold Nebraska,” Johanns said in an interview. “It’s the average guy out there who’s got to fill up his car.”Such political jostling over the murky nuances of oil markets often glosses over some of the escape hatches in the State Department’s price scenario: For the death of the pipeline to slow Canadian oil sands growth — and the resulting greenhouse gas emissions — other major export projects for the Canadian fuel would also have to run into problems, the study said.That “pipeline-constrained” scenario was taking shape even before this fall’s oil crash, thanks to an obstruction campaign by climate activists and indigenous peoples on both sides of the border. Three other massive pipeline projects that would funnel crude from Canada’s oil-rich Alberta province to its coastlines have met fierce resistance from greens.The other pipelines represent “‘all of the above’ options,” Canadian Association of Petroleum Producers Vice President Greg Stringham said by email. “However, Keystone XL is the most direct route to the largest heavy oil market and remains a key part of North American energy security,” he added.

University of Alberta energy policy professor Andrew Leach has pointed to Canada’s weak currency as a “shock absorber” that insulates its oil producers from some of the financial pain of plummeting oil. But when asked about any possible upside for Keystone, he added, “I can’t see how a big decrease in oil prices makes the case for any pipeline stronger.”

Follow @politico

And now a word from the Editors of The Greanville Post

FRIENDS AND FELLOW ACTIVISTS—

AS YOU KNOW, THERE’S A COLOSSAL INFORMATION WAR GOING ON, AND THE FATE OF THE WORLD LITERALLY HANGS ON THE OUTCOME.

THEIR LIES.

THEIR CONSTANT PROPAGANDA.

OUR TRUTH.

HUGE ISSUES ARE BEING DECIDED: Nuclear war, whether we’ll live in democracy or tyranny, dignity or destitution, planetary salvation or doom…It’s a battle of communications we can’t afford to lose.

So, we request that you do something.

Reading is not enough. Action of some sort is needed.

Start with something simple: Share our posts.

If you don’t, how can we ever neutralize the power of the corporate media?

And if you took the time to read this article, and found it worth SHARING, then why not sign up with our special bulletin to be included in our future distributions? And please tell others about The Greanville Post.

YOUR SUBSCRIPTIONS (SIGNUPS TO THE GREANVILLE POST BULLETIN, SEE BELOW) ARE COMPLETELY FREE, ALWAYS. AND WE DO NOT SELL OR RENT OUR EMAIL ADDRESS DATABASES—EVER. That’s a guarantee.