The new kings of oil

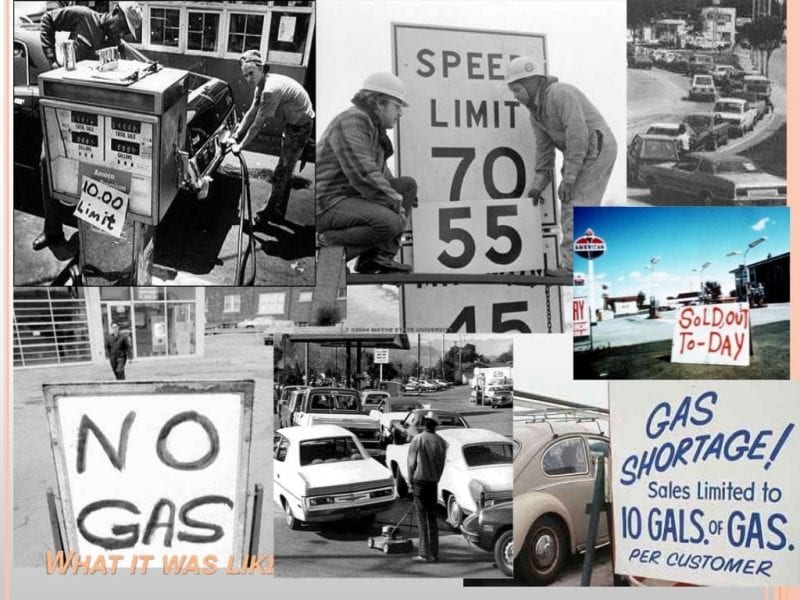

Montage of 1973 oil embargo issues in US by Richard Modi.

The 1950's could be called the Golden Age of American Big Oil, the handful of giant oil companies that were part of or closely allied to the Rockefeller Standard Oil empire. The combined trusts and foundations owned by the Rockefeller family at the end of the war effectively held controlling shares in the three most important international oil companies -- Standard Oil of California (Chevron), Standard Oil of New Jersey (Exxon) and Standard Oil of New York (Socony, later Mobil). [i]

At the pinnacle of that oil empire stood the four Rockefeller brothers. David, the youngest, went into the family bank, Chase National Bank, which began to emerge as New York’s second strongest international bank, in no small part because it was the house bank to Rockefeller Standard Oil interests worldwide.

Nelson, who had already played an influential role in advising Democratic President Franklin Roosevelt and who emerged as FDR's most influential policy figure in Latin America, had made a seamless shift to become an Eisenhower Republican by 1952. From that Republican pinnacle, Nelson oversaw a reorganization of the entire US Government and went on to become Special Assistant to the President for Psychological Warfare, shaping Cold War responses to the Soviet Union.

Brother John D. III, who had played a central role in postwar Japan and in population control programs, was also heading the Rockefeller Brothers Fund and the Rockefeller Foundation, whose grants were shaping the future of academic research worldwide, all to the ultimate benefit of the family's private agenda.

The fourth of the politically active brothers Laurance, the business entrepreneur of the four, founded, among others: Eastern Airlines -- partly to shuttle cheap non-union labor to the New York garment industry from Puerto Rico; McDonnell Aircraft Co.; and later in the 1960's, through his Venrock venture capital group, a small semiconductor company called Intel Corporation.[ii]

The Rockefeller brothers' vast influence in the postwar years went well beyond the four brothers, however. It spread through corporate interlocking directorates among key defence firms such as McDonnell Aircraft, Monsanto, DuPont, Hercules Powder, Nuclear Development Corporation, General Electric, Rockwell Manufacturing and scores of other holdings along with their core holdings in the various Standard Oil companies. Rockefeller influence also operated through the highly elite and highly influential private foreign policy think-tank, the Council on Foreign Relations (CFR), which Rockefeller money and J.P. Morgan money helped to establish in the corridors of the 1919 Versailles Peace talks.[iii]

John Foster Dulles, as partner of the Wall Street law firm, Sullivan & Cromwell, had represented Rockefellers’ Standard Oil and was a Trustee of the Rockefeller Foundation. Married into the Rockefeller family, he also served as Chairman of the Board of the Rockefeller Foundation before becoming Secretary of State.[iv]

The Rockefeller dynasty, in brief, was well positioned in the Eisenhower years immediately after World War II to advance the interests of its new global oil empire.

Despite laws prohibiting price-fixing cartels in American industry, the large oil companies were able to exert influence in Washington to ignore such restraints when it came to oil. The influence of the Rockefeller group in postwar Washington was immense and it spanned both Democratic and Republican parties.

After the war, even as the power of the oil cartel grew exponentially, Washington looked the other way, permitting monopoly practices that no other group could enjoy. By 1950 the major Rockefeller oil companies were seamlessly inter-linked with the emerging American "national security state." The growing Pentagon war machine was one of the largest consumers of oil and gas. Oil was a sacred cow not to be touched. It was considered too important for American economic security to be left to the free market or constrained by anti-trust laws.[v]

Within the United States and later across the non-communist world, the social engineers and scientists advising the Rockefellers and other leading powers of the American East Coast Establishment -- as the combined oil and banking interests of Wall Street and Standard Oil were called -- devised an ingenious and ultimately diabolical method of using energy as a lever of social control. They tested it first on the American population and later expanded the model to encompass the world economy.

In 1948 the Rockefeller Foundation gave what was then a very substantial grant of $100,000 to Harvard University's young Russian-born economist, Wassily Leontief.[vi]

Leontief, an economist who had left the Soviet Union during his university studies and emigrated to the United States, set up the Harvard Economic Research Project just after the war. His aim was to develop an accurate, dynamic economic model based on his development of industry-by-industry input and output data. Leontief's project, part of which became the Harvard Business School's "agribusiness" model under Professors Ray Goldberg and John H. Davis, was generously financed with Rockefeller money throughout the 1950's.

Later the Ford Foundation, whose work was closely tied to the US foreign policy agenda -- and often to that of the CIA during the 1950’s -- joined with Rockefeller to co-finance Leontief's ambitious project. It was the first application of modern digital IBM computers to study complex economic variables.[vii]

Energy, not surprisingly, was at the heart of that social engineering. Entire populations would be manipulated -- in ways they would not grasp -- to become drones, in effect, of powerful elite industrial dynasties, such as the Rockefellers, DuPonts, Carnegies and Fords. The concepts emerged from Operations Research, a strategic and tactical methodology developed for military management during World War II.

The original purpose of Operations Research was to study and solve the strategic and tactical problems of air and land defense, in order to maximize use of limited military resources against an enemy. Some foresighted persons in positions of power realized that the same methods might be useful for controlling an entire society. Rockefeller Foundation people then approached Leontief at Harvard.[viii] His project was to model ever greater sectors of the United States economy. Later versions expanded the input-output analysis, as computing power and data sources grew, to model the global economy—first the United States’ economy then that of the entire world.[ix]

‘Managing limited resources' -- as developed in the Leontief applications of Operations Research -- became the heart of the Rockefeller group’s economic strategy after the 1950's. However, they were determined to be the only ones to decide when where and by how much to limit the most valuable of those allegedly ‘limited’ resources -- oil.

With evolving and increasingly sophisticated econometric tools to describe and ‘map’ the total economy and its energy requirements well into the future, and having engineered the transformation of the economy of the United States from coal-driven rail to oil-driven transport, the Standard Oil group, their allies at Shell, and what was then called Anglo-Iranian Oil Company (later British Petroleum) became increasingly concerned that their carefully constructed edifice of world oil domination might collapse if too much oil were to suddenly flood the market.

Then, in 1948, the Rockefeller Standard Oil companies within their Saudi Arabian-based company, ARAMCO -- Arab-American Oil Company -- discovered the world's largest-ever oil field at Ghawar. That one gargantuan field had produced 55 billion barrels of oil by 2005, and, despite claims to the contrary, continued to produce at a staggering rate of five million barrels per day more than half a century later, dwarfing every previous oil discovery in the world. The discovery of Ghawar oil field changed the world of oil overnight, and set the stage for the strategy of making the oil-rich USA oil import- dependent.

It was, however, far from the only giant new oil discovery at that time.

Ghawar was followed in 1953 by discovery of the giant Rumalia oil field in Iraq. Fortunately for the power calculus of Rockefeller’s American oil majors and their closely allied British oil companies, Shell and Anglo-Iranian (BP), most major new giant fields were under the Rockefellers’ direct control.

With the immense new fields of Saudi Arabia, Kuwait and the Middle East under their control, the US oil majors around the Rockefeller group decided it would be far better to use their ultra-cheap Mideast oil instead of the domestic US supply which often cost considerably more to extract and was too often in the hands of smaller independent oil companies.

In the early 1950s, a critical economic consideration was the difference in lifting costs – operating costs: Saudi or other Middle East oil operations typically cost some 400% to 500% less compared with those in West Texas, California or Oklahoma. It cost US-Saudi ARAMCO oil companies about $0.20 to produce a barrel of Saudi oil that they sold to the market in the 1950's for $1.75. Under a special tax arrangement -- on the argument of US national security -- the US Treasury paid a sum, termed a Foreign Tax Credit, to the Saudi Government to insure the flow of cheap Saudi oil that was, in effect, bankrupting domestic US independent oil producers. The ARAMCO American oil companies got away with paying no taxes either in the US or in Saudi Arabia.[x]

Little wonder that the major oil companies began a concerted drive to flood the domestic US oil market with their cheap Middle East oil, conveniently bankrupting thousands of small and medium-sized independent US oil producers.

Despite all this, however, the Rockefeller oil majors faced a nightmare scenario. In a world where their control over oil -- by then the prime energy driving the global economy -- was the key to global power, they knew that significant non-Anglo-American players, as well as national oil companies not under the Rockefeller thumb, could also discover huge new fields such as Ghawar or Rumalia, thus ending the Anglo-American control of world oil.

A radical new approach to their control of oil became urgent.

As a first step, the major American and British oil interests concluded that a plausible scientific argument was needed that would propagate the convenient (for them) myth that the world’s petroleum resources were finite and depleting rapidly. For this job, they chose an eccentric petroleum geophysicist from the University of Chicago who was working for Shell Oil in Texas, a man with the curious name, Marion King Hubbert, or M. King, as he preferred to be known.

Hubbert posited all of his 1956 conclusions on the unproven assumption that oil was a fossil fuel, a biological compound produced from dead dinosaur detritis, algae or other life forms originating some 500 million years back. Hubbert accepted the fossil theory without question, and made no evident attempts to scientifically validate such an essential and fundamental part of his argument. He merely took ‘fossil origins of oil’ as Gospel Truth and began to build a new religion around it, a neo-Malthusian religion of austerity in the face of looming oil scarcity.

Moreover, as Hubbert admitted in a remarkably frank interview in 1989 shortly before his death, the method he used to calculate total recoverable US oil reserves was anything but scientific. It might be compared with wetting one’s finger and holding it up to see how strong the wind is blowing.

Hubbert told his interviewer,

"What was required there was that I need to know or have an estimate of the ultimate amount that could be produced...I know the ultimate and I know, I can only tailor that curve within a very narrow range of uncertainty. So that's what was done. Those curves were drawn. I simply, by cut and dry, I mean, you drew the curve, calculated the squares, and if it was a little too much you trimmed it down or too little, you upped it a little. But there was no mathematics involved, other than the integral area under the curve, the integral pd dq by, at times, et, for accumulated production up to a given time...So with the best estimates I could get on the ultimate amount of oil in the United States, my own figure at the time was about 150 billion barrels." [xi]

Hubbert stated that the assumption that oil derives from fossil remains made the job of estimating its decline rather simple: "This knowledge provides us with a powerful geological basis against unbridled speculations as to the occurrence of oil and gas. The initial supply is finite; the rate of renewal is negligible; and the occurrence is limited to those areas of the earth where the basement rocks are covered by thick sedimentary deposits." [xii]

Hubbert made no attempt to demonstrate that even were oil restricted to "areas of the earth where the basement rocks are covered by thick sedimentary deposits," that all such areas had already been thoroughly explored for petroleum potential. Barely a tiny fraction of the earth had even been touched by oil drills when he made his dire forecast in 1956.

Almost a quarter century later, Michael T. Halbouty, a well-respected Texas oil geologist and petroleum engineer, an outspoken advocate of increased domestic United States oil exploration, wrote in the Wall Street Journal in 1980:

"[There are] approximately 600 prospective petroleum basins in the world. Of these 160 are commercially productive, 240 are partially or moderately explored and the remaining 200 are essentially unexplored. Around the globe 3,444,664 wells had been drilled up to 1978. Of this amount, 2,513,500 or 73 percent were drilled in the United States. Yet the prospective basin areas of this country...comprise only 10.7 percent of the world's total. Thus 89.3 percent of the world's prospective basins saw only 27 percent of the wells drilled...The majority of the world's basins have not been adequately explored or drilled." [xiii]

Such facts were of no evident interest to Hubbert or to the big international oil companies.

Armed with his unproven hypothesis of finite oil, Hubbert proceeded to predict that, based on his estimates of total US oil reserves of 150 to 200 billion barrels, the United States output of petroleum would peak in the last 1970s and an accelerating bell curve decline in oil would begin. It was an alarming picture, to put it mildly. It was also false.

To illustrate his paper, giving it the appearance of real science, Hubbert adopted the idealized bell curve invented as a heuristic tool in the 19th Century by the German mathematician Karl-Friedrich Gauss, the Gauss Curve. Hubbert neglected anywhere in his writings then or later to demonstrate why the Gaussian Bell Curve described oil reservoir behaviour in all cases. He merely asserted it was so. The Hubbert curve was not based on empirical data from actual oil fields but rather, an assumption about what Hubbert claimed was the case with all oilfields. He then made guesstimates of how much total oil existed, based on his guessed amounts of fossilized remains trapped in sedimentary zones within the United States. [xiv]

A colleague of Hubbert's at Shell in Houston during the 1950's, Kenneth Deffeyes, remarked, "The numerical methods that Hubbert used to make his predictions are not crystal clear. Today, 44 years later, my guess is that Hubbert, like everybody else, reached his conclusion first then searched for raw data and methods to support his conclusion. Despite sharing roughly 100 lunches and several long discussions with Hubbert, I never had the guts to cross-examine him about the earliest roots of his prediction." [xv]

Hubbert's himself admitted, in an extensive interview shortly before his death, that prior to delivering his 1956 speech predicting the imminent, dramatic decline of petroleum production in the United States, he had given his paper to the chairman of Royal Dutch Shell to read first. Hubbert stated that, "the managing director of Shell's only comment was, he hoped that I would counteract these essentially over-estimates of L.G. Weeks."[xvi]

L.G. Weeks, at the time the most well-respected oil reserve researcher in the USA, had estimated 400 billion barrels of recoverable oil and was regularly revising the amount higher, something the large oil companies found highly unsatisfactory. If oil were so abundant, how could they justify holding the price high and even putting it higher in the future? [xvii]

Hubbert apparently heard the clear message from his boss at Shell. In his speech he used a maximum estimate of only 200 billion barrels of oil in the United States and predicted a decline in total US oil output by 1970.

In his same 1956 paper, M. King Hubbert estimated total world Ultimate Potential Reserves of Oil to be 1,250 billion barrels. In 2008, however, the BP Statistical Review of World Energy estimated total world oil reserves to be somewhere between 1.8 trillion barrels and 2.2 trillion barrels.

Of the totality of oil consumed since the onset of the modern petroleum era more than a century ago, approximately 90% of all the petroleum that has ever been consumed was used after 1958. That would translate into almost 1000 billion barrels used, out of Hubbert's estimate of 1250 billion barrels remaining as of 1956. [xviii]

If some 83% of Hubbert's total reserves had been used up by 2008, how was it possible that there was still an estimated amount left in 2008 that was almost double the total "scientifically" estimated by Hubbert in 1956? Clearly there were serious discrepancies in the Hubbert projections.

For Hubbert’s powerful oil industry sponsors and the influential establishment circles using him for their political agenda, it did not matter. After all, no one would bother to look at the details. They would only remember the headline: “Oil is finite and will peak in 1970 in the USA and soon thereafter in the entire world.” No one can object then to higher prices, can they?

Hubbert proposed this energy-driven economic model in a paper he wrote in 1938 when he was a member of a cult-like group calling itself Technocracy Incorporated. The group advocated that society be ruled by technocrats --scientists and engineering experts. Such experts, Hubbert and his fellow technocrats maintained, knew better than ordinary people which choices were best for society. In the 1930s, Hubbert’s Technocracy Incorporated wore grey shirts and monad insignia lapel pins, and saluted when they encountered the group’s founder, Howard Scott, leading to a barrage of negative media coverage suggesting similarities with Italian fascist practices under Mussolini’s dictatorship and cult of personality.[xx]

In 1933, the year Hitler seized power in Germany, the Technocracy Incorporated founding statement declared, “Technocracy is not misled by emotional optimism created by temporary palliatives. Its findings prove why no ‘new deal,’ but an entirely ‘new game,’ based upon an accurate ‘balanced load’ method of social control is the only solution for the problems facing this continent.” [xxi]

In brief, Hubbert’s Technocracy organization advocated a system of centralized top-down social control by elite technocrats. Little attention was given to how the moral fiber and behavior of the technocrats might be guaranteed for the greater good of the overall society. Nonetheless, there is no record that Hubbert ever disavowed Howard Scott or Technocracy Inc.

Hubbert advocated a technocratic society based on energy not entirely unlike the top-down carbon credit model decades later espoused by advocates of global warming mythology during the Obama Administration.

The core of the Technocrats' vision was "an energy theory of value." Since the basic measure common to the production of all goods and services was energy, they reasoned that the sole scientific foundation for the monetary system was also energy. Hubbert proposed, “We distribute purchasing power in the form of energy certificates to the public, the amount issued to each being equivalent to his pro rata share of the energy-cost of the consumer goods and services to be produced during the balanced-load period for which the certificates are issued. These certificates bear the identification of the person to whom issued and are non-negotiable.” [xxii]

In effect the Hubbert energy-regulated economic system would insure that as oil reserves declined in availability as the primary energy source for a country or the world as a whole, the disposable income or standard of living would sink along with it. The theme was to be revisited several times in later decades by the Rockefeller circles and their various organizations and think tanks.

During the Second World War, Hubbert had served in the Federal Government’s Board of Economic Warfare until 1943, when he went to Shell Petroleum Company to make his career as a geophysicist. Thus the eccentric technocrat who worked for Big Oil, promoting their myth that oil was running out, understood the basics of how oil could be used as a weapon of economic warfare. Whether he realized it or not, in 1956 that weapon was turned against the American people, not against any external enemy.

Hubbert was rewarded for his effort by the powerful oil establishment. He was elected to the American Academy of Arts and Sciences in 1957; he received the Geological Society of America's Arthur L. Day Medal in 1959, and became the society's president in 1962, giving an aura of prestige and needed credibility to his thesis of oil peaking.[xxiii]

Their argument was essentially that their Middle East oil operations should get preferential tax and other treatment over domestic US oil, oil that in any case soon would decline. They could point to the work of Hubbert as "proof."

The big oil majors, using Hubbert’s pseudo-science as backup, argued in Washington that their Mideast oil was a US “national security” priority. A joint report by the US State and Defense Departments in the 1950's noted, “American and British oil companies . . . play a vital role in supplying one of the free world’s most essential commodities. The maintenance of, and avoiding harmful interference with, an activity so crucial to the well-being and security of the United States and the rest of the free world must be a major objective of United States government policy.” [xxvi]

Meanwhile, in 1952 Dwight D. Eisenhower, the Commander of Allied Forces in Europe during the Second World War, had become the US President and John Foster Dulles, former head of the Rockefeller Foundation and a Standard Oil attorney, was appointed as Eisenhower's Secretary of State.

The result was that the monopoly power of the Rockefeller oil cartel became a forgotten issue in Washington; the new foreign policy mythology became "anti-communism." It was indeed an Anglo-American oil world in the 1950's, and the Rockefeller group controlled that world, at least outside the United States.

In one of its first moves to expand their control, in 1953 CIA head Allen Dulles and his brother, Secretary of State John Foster Dulles had persuaded Eisenhower to authorize a CIA-backed coup to oust popular nationalist Iranian Prime Minister Mohammed Mossadeq, who was in a bitter battle with British Petroleum, then called Anglo-Iranian Oil Company. The Iranian Parliament had voted to nationalize Anglo-Iranian following the company's repeated refusals to renegotiate better terms with Iran. The British government, owner of 51% of Anglo-Iranian shares, discussed the possibility of an invasion of Iran to occupy the oil area around Abadan, on the Persian Gulf. By 1952 the US Government authorized a covert operation to depose the popular nationalist Mossadeq and bring back the despotic Shah as their proxy.

The CIA, with British MI-6 support, began a well-financed subversive action against Mossadeq, painting him falsely in US and Western media as sympathetic to the Soviet Union for his call to legally nationalize Anglo-Iranian Oil. The CIA coup, led by Kermit Roosevelt, forced Mossadeq out of office and, with US backing, and abundant bribes to religious leaders, a brutal dictatorship under the Shah was returned to Tehran.

As quid pro quo for helping their British cousins, Washington extracted a heavy price on behalf of the Rockefeller oil group. What had been the sole domain of British oil since 1908 now had to be shared with the American Rockefeller companies. British Petroleum, as the company was renamed after the coup, would henceforth get a mere 40% share of Iranian oil. Each of the five Rockefeller-linked US sisters got 8% or a total of 40%, and Shell got 14%, while the weaker French CFP got 6%.

The CIA oil coup in Iran was a major signal to other oil producing countries not to get any ideas of nationalizing their oil and gaining independence from Washington or from Big Oil.

Arabian oil was the lowest cost oil on the world market in the early 1950s, by far. At that time, the sentiment in both the White House and the US Congress was that defending domestic oil production and reducing dependence on high-risk Middle East oil was the "national security" priority.[xxviii]

Few during the height of the Cold War and the height of McCarthyism dared challenge national security arguments. For Mobil, Chevron and the other so-called Seven Sister Anglo-American oil majors of the time, the economics of controlling Mideast oil were staggeringly favorable. They simply set out to redefine the term "US national Security."

With their other tax concessions from Washington added in, the American oil majors could lift crude oil from the ground in Saudi Arabia during the 1950‘s for less than $0.20 a barrel and sell it in the US refinery markets or in Europe for some $3.00 or more a barrel, a profit of at least 1200%. The only commodity that came close to such rates of return was illegal heroin traded from Laos and Burma -- where the cost of transport was subsidized unwittingly by the American taxpayer in the form of supporting the CIA’s Air America during the Vietnam War.[xxix]

By sheer force of the Big Oil lobby in Washington and their bankers on Wall Street, led by Chase Manhattan Bank and Citibank, the imports of cheaper Middle East oil into the United States overwhelmed the argument for more domestic oil production.

The shift from domestic to imported oil reliance that began towards the end of the 1950's and accelerated into the 1960's, paralleled the rise of US military and diplomatic presence in the Middle East. Contrary to what had been considered prudent during the early 1950's, the powerful propaganda machine of the Rockefeller faction managed now to define US "national security" as controlling the oil fields of Saudi Arabia, Iran, and the Persian Gulf. It would prove to be a fateful re-definition.

By the beginning of the 1970's, the strategic importance of Middle East oil to the US economy and to the Western world had become paramount. King Hubbert's prediction of a peak in domestic US oil production by 1970 came to pass, more or less like clockwork in 1970.

By the early 1970's with the United States and Western Europe increasingly dependent on Middle East oil as never before, the stage was set for the boldest manipulation of world oil markets yet. The leading US and British oil titans, along with the most select bankers of New York and the City of London and a handful of high-ranking government officials from the United States and Western Europe met in a high security island retreat just outside Stockholm, Sweden to lay the groundwork for a global oil price shock.

They were about to test the reactions of the world to a deliberate 400% rise in the dollar price of oil, the most dramatic application of their oil weapon -- their “silent weapon for quiet wars.” Hubbert's greatest day of glory was about to come.

Born in Minneapolis, Minnesota, United States, Engdahl is the son of F. William Engdahl, Sr., and Ruth Aalund (b. Rishoff). Engdahl grew up in Texas and after earning a degree in engineering and jurisprudence from Princeton University in 1966 (BA) and graduate study in comparative economics at the University of Stockholm from 1969 to 1970, he worked as an economist and freelance journalist in New York and in Europe. Engdahl began writing about oil politics with the first oil shock in the early 1970s. His first book was called A Century of War: Anglo-American Oil Politics and the New World Order and discusses the alleged roles of Zbigniew Brzezinski and George Ball and of the USA in the 1979 overthrow of the Shah of Iran, which was meant to manipulate oil prices and to stop Soviet expansion. Engdahl claims that Brzezinski and Ball used the Islamic Balkanization model proposed by Bernard Lewis. In 2007, he completed Seeds of Destruction: The Hidden Agenda of Genetic Manipulation. Engdahl is also a contributor to the website of the anti-globalization Centre for Research on Globalization, the Russian website New Eastern Outlook,[2] and the Voltaire Network,[3] and a freelancer for varied newsmagazines such as the Asia Times. William Engdahl has been married since 1987 and has been living for more than two decades near Frankfurt am Main, Germany.

Born in Minneapolis, Minnesota, United States, Engdahl is the son of F. William Engdahl, Sr., and Ruth Aalund (b. Rishoff). Engdahl grew up in Texas and after earning a degree in engineering and jurisprudence from Princeton University in 1966 (BA) and graduate study in comparative economics at the University of Stockholm from 1969 to 1970, he worked as an economist and freelance journalist in New York and in Europe. Engdahl began writing about oil politics with the first oil shock in the early 1970s. His first book was called A Century of War: Anglo-American Oil Politics and the New World Order and discusses the alleged roles of Zbigniew Brzezinski and George Ball and of the USA in the 1979 overthrow of the Shah of Iran, which was meant to manipulate oil prices and to stop Soviet expansion. Engdahl claims that Brzezinski and Ball used the Islamic Balkanization model proposed by Bernard Lewis. In 2007, he completed Seeds of Destruction: The Hidden Agenda of Genetic Manipulation. Engdahl is also a contributor to the website of the anti-globalization Centre for Research on Globalization, the Russian website New Eastern Outlook,[2] and the Voltaire Network,[3] and a freelancer for varied newsmagazines such as the Asia Times. William Engdahl has been married since 1987 and has been living for more than two decades near Frankfurt am Main, Germany.